Commercial Auto Policy: How to Avoid Coverage Gaps sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

In this guide, we delve into the intricacies of commercial auto policies, shedding light on the importance of comprehensive coverage and the pitfalls to avoid.

Importance of Commercial Auto Policy

Having a commercial auto policy is crucial for businesses to protect their vehicles, employees, and finances in the event of accidents or other unforeseen circumstances.

Differences between Commercial Auto Policy and Personal Auto Policy

- Commercial auto policies are specifically designed to cover vehicles used for business purposes, while personal auto policies are meant for personal use only.

- Commercial auto policies typically have higher liability limits to protect businesses from potential lawsuits.

- Commercial auto policies may cover multiple drivers and vehicles under one policy, which is not common in personal auto policies.

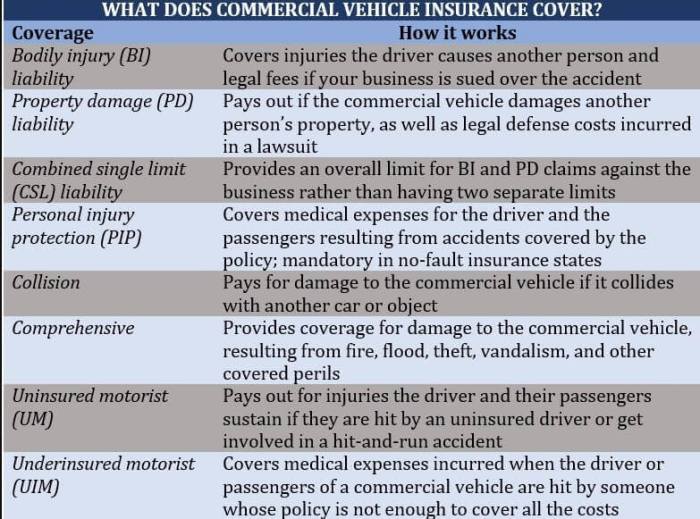

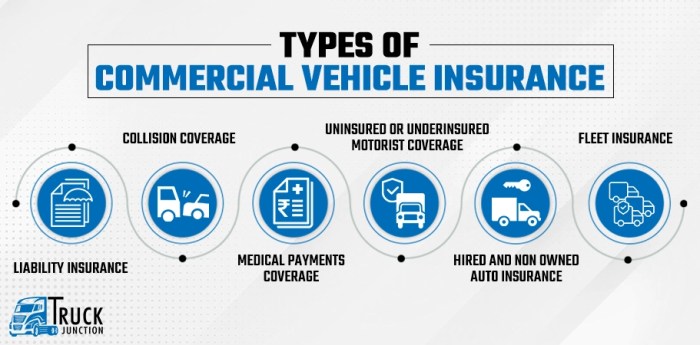

Common Risks Covered by Commercial Auto Policy

- Liability coverage for bodily injury or property damage caused by the business vehicle.

- Collision coverage for damage to the vehicle in the event of an accident.

- Comprehensive coverage for non-collision related incidents such as theft, vandalism, or weather damage.

Coverage Gaps in Commercial Auto Policies

When it comes to commercial auto insurance, coverage gaps can pose significant risks to businesses. These gaps can occur when there are misunderstandings or oversights in the policy, leaving the business vulnerable to financial losses in case of an accident or other unforeseen events.

Common Scenarios of Coverage Gaps

- Underinsured Drivers: Businesses may assume that all drivers are adequately insured under their commercial auto policy. However, if an employee is involved in an accident while driving their personal vehicle for work purposes, there may be coverage gaps if the employee’s personal auto insurance does not provide sufficient coverage.

- Non-Owned Vehicles: Another common scenario is when a business rents or borrows vehicles for business use. If these vehicles are not specifically listed on the commercial auto policy, there could be coverage gaps in case of an accident.

- Unreported Vehicle Modifications: If a business makes modifications to their vehicles without informing the insurance company, these changes may not be covered in the policy, leading to coverage gaps in the event of a claim.

Financial Risks of Coverage Gaps

Coverage gaps in commercial auto policies can result in financial consequences for businesses. Without adequate coverage, businesses may be liable for costly repairs, medical expenses, legal fees, and even lawsuits in the event of an accident. These financial risks can have a significant impact on the overall financial health and stability of the business.

Ways to Identify Coverage Gaps

When it comes to a commercial auto policy, it is crucial to thoroughly review and identify potential coverage gaps to ensure your business is adequately protected. Regular policy reviews and updates are essential in avoiding any unexpected surprises that could leave you vulnerable.

Here are some tips to help you assess your specific needs and ensure comprehensive coverage:

Review Policy Exclusions and Limitations

One of the first steps in identifying coverage gaps is to carefully review the policy exclusions and limitations. Pay close attention to any specific scenarios or types of vehicles that may not be covered under your current policy. Understanding these exclusions can help you determine where additional coverage may be needed.

Assess Business Operations and Risks

Take the time to assess your business operations and associated risks. Consider the types of vehicles used, the frequency of use, the territories in which they operate, and any specialized equipment being transported. By understanding your unique risks, you can tailor your policy to provide adequate protection for your specific needs.

Consult with an Insurance Professional

Seeking guidance from an insurance professional can be invaluable in identifying coverage gaps. An experienced agent can help you navigate the complexities of commercial auto policies and provide insight into areas that may require additional coverage. They can also assist in ensuring that your policy is up-to-date and meets your evolving business needs.

Stay Informed of Industry Changes

Stay informed of any changes in regulations, laws, or industry standards that may impact your commercial auto policy. By staying proactive and informed, you can adjust your coverage accordingly to address any new risks or requirements that arise. Regularly reviewing your policy in light of these changes can help you avoid coverage gaps.

Strategies to Avoid Coverage Gaps

When it comes to commercial auto insurance, avoiding coverage gaps is crucial for protecting your business from potential financial risks. By implementing proactive strategies and customizing your policy with endorsements, you can tailor your coverage to suit your specific needs and mitigate any potential gaps in protection.

Customization and Endorsements

- Customizing your commercial auto policy with specific endorsements can help fill coverage gaps that may exist in a standard policy. For example, adding an endorsement for hired and non-owned auto coverage can provide protection when employees use their personal vehicles for work-related purposes.

- Consider customizing your policy based on the unique needs of your business. Whether you operate a fleet of vehicles or rely on employees to use their own cars for work, working with your insurance provider to tailor your coverage can help ensure you have the protection you need.

Additional Coverage Options

- Uninsured/underinsured motorist coverage can help protect your business in case of an accident with a driver who doesn’t have sufficient insurance. This coverage can fill gaps left by inadequate coverage carried by other drivers.

- Rental reimbursement coverage can be beneficial if your business relies on rental vehicles while yours are being repaired after an accident. This additional coverage can help avoid disruptions to your operations.

Epilogue

As we wrap up our discussion on Commercial Auto Policy: How to Avoid Coverage Gaps, it’s clear that vigilance and customization are key to ensuring your business is shielded from potential risks. By implementing the strategies Artikeld here, you can navigate the complex landscape of insurance with confidence and peace of mind.

Quick FAQs

What are the key differences between a commercial auto policy and a personal auto policy?

A commercial auto policy is specifically designed to cover vehicles used for business purposes, while a personal auto policy is intended for personal use vehicles. Commercial policies usually have higher coverage limits and different types of coverage tailored for business needs.

How often should businesses review their commercial auto policy to avoid coverage gaps?

It’s recommended that businesses review their commercial auto policy at least annually, or whenever there are significant changes in their operations or fleet. Regular reviews can help identify gaps and ensure adequate coverage.

What additional coverage options can businesses consider to fill potential gaps in their commercial auto policy?

Businesses can explore options like hired and non-owned auto coverage, umbrella liability insurance, or endorsements for specific risks not covered in a standard policy. These additional coverages can provide an extra layer of protection.