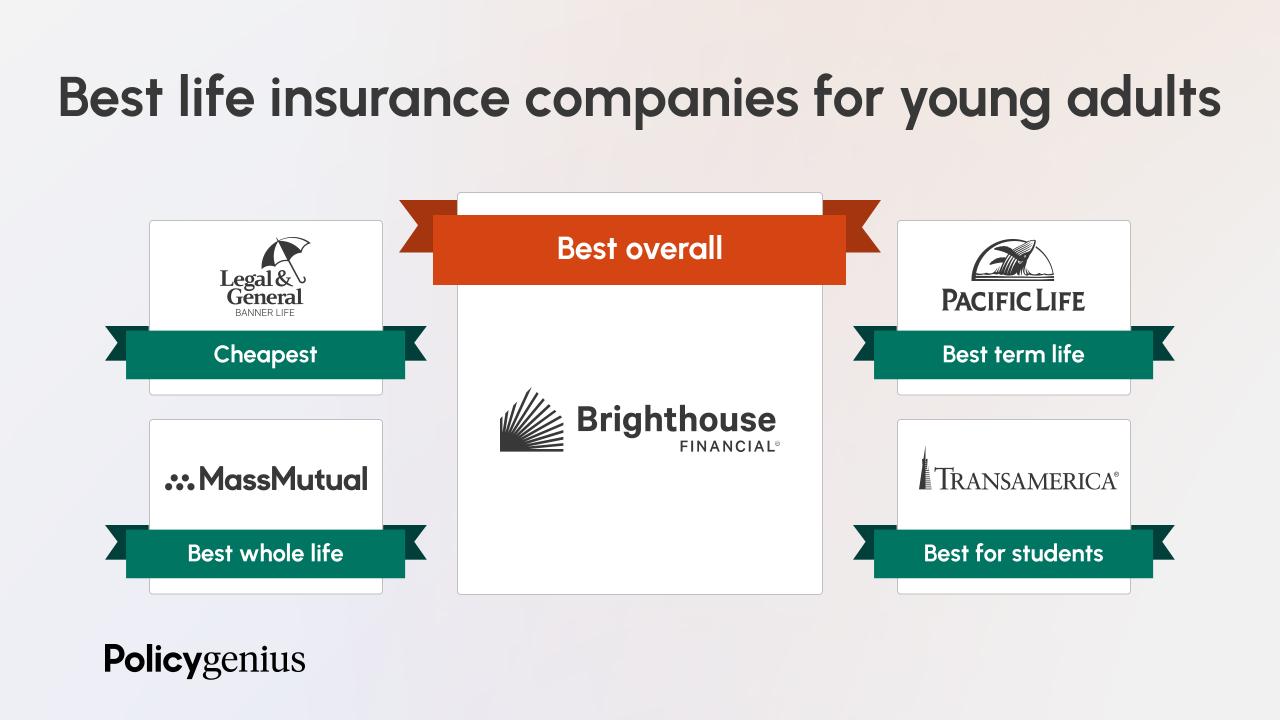

Embark on a journey to discover the best life insurance options tailored for young adults. This guide is designed to provide you with valuable insights and essential information to make informed decisions about securing your financial future.

Delve into the nuances of different life insurance types, factors to consider when choosing a policy, benefits of starting early, and practical tips to obtain affordable coverage.

Types of Life Insurance for Young Adults

Life insurance is an essential financial tool that provides protection and peace of mind for young adults. There are several types of life insurance options available for young adults, each with its own features and benefits. Let's explore the differences between term life insurance, whole life insurance, and universal life insurance for young adults.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiary if the insured passes away during the term of the policy. Term life insurance is often more affordable than other types of life insurance, making it a popular choice for young adults who are looking for basic coverage at a lower cost.

It is ideal for those who have temporary financial obligations, such as student loans or a mortgage, that will be paid off within a certain timeframe.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured, as long as premiums are paid. In addition to the death benefit, whole life insurance also includes a cash value component that grows over time. This cash value can be used for various purposes, such as borrowing against the policy or supplementing retirement income.

Whole life insurance is suitable for young adults who want lifelong coverage and the opportunity to build cash value over time.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust their coverage as their needs change. This type of insurance also includes a cash value component that earns interest based on market rates. Universal life insurance is best suited for young adults who want the flexibility to modify their coverage and have the potential to accumulate cash value over time.Overall, the choice between term life insurance, whole life insurance, and universal life insurance for young adults depends on individual financial goals, budget, and coverage needs.

It is essential to consider factors such as affordability, coverage duration, cash value accumulation, and flexibility when selecting the right type of life insurance for your circumstances.

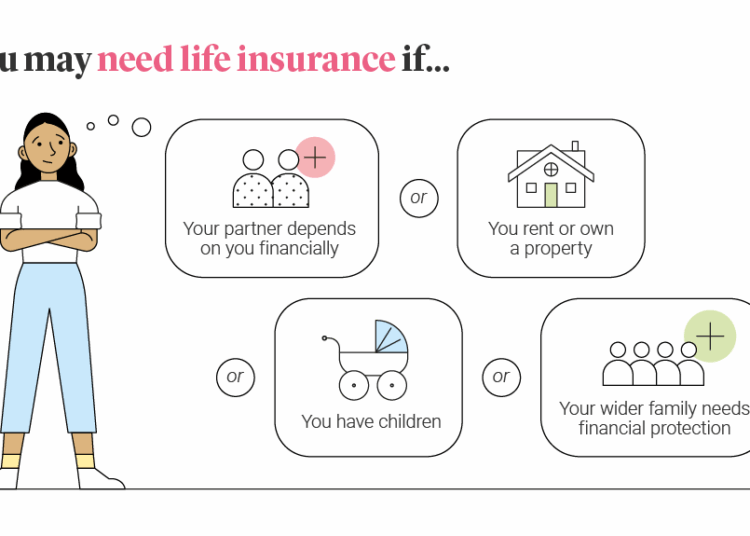

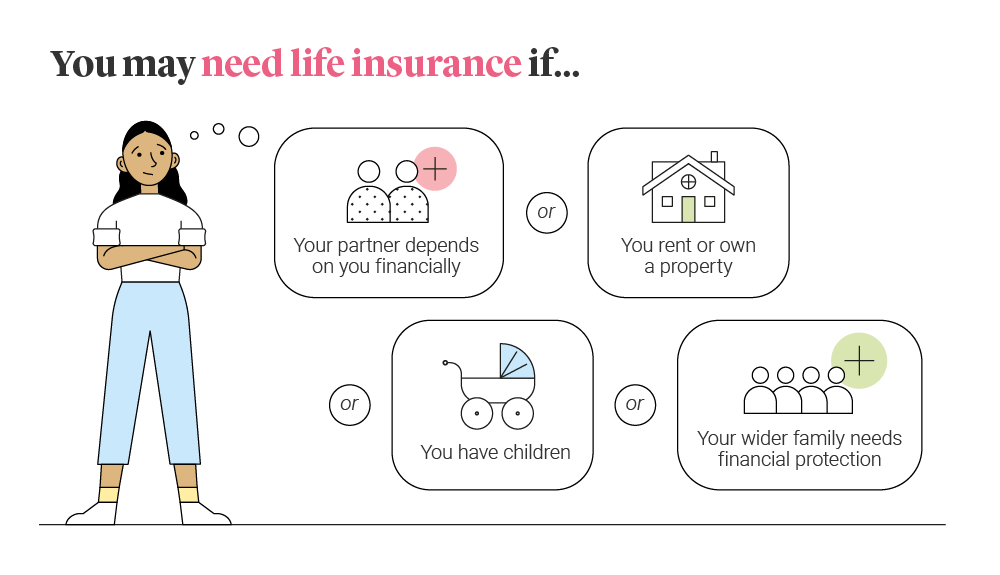

Factors to Consider When Choosing Life Insurance as a Young Adult

As a young adult, selecting the right life insurance policy is crucial to secure your financial future and protect your loved ones. Several key factors should be taken into consideration when making this important decision.

Coverage Amount

Determining the appropriate coverage amount is essential when choosing a life insurance policy as a young adult. Consider factors such as outstanding debts, future financial obligations, and the needs of your dependents. It's important to strike a balance between providing adequate coverage and ensuring affordable premiums.

Premiums

The cost of premiums is a significant factor to consider when selecting a life insurance policy. As a young adult, you may have the advantage of lower premiums due to your age and generally good health. However, it's important to compare quotes from different insurers to find the most competitive rates while still maintaining sufficient coverage.

Duration

The duration of the life insurance policy is another important factor to consider. Think about your long-term financial goals and how long you will need coverage. Some policies may offer flexibility in terms of duration, allowing you to adjust the length of coverage based on your evolving needs.

Personal Circumstances

Your personal circumstances, such as your health, financial goals, and dependents, play a significant role in determining the right life insurance policy for you. If you have any pre-existing health conditions, it's important to disclose this information to insurers to ensure you get the appropriate coverage.

Additionally, consider the financial needs of your loved ones and how long they may depend on your income.

Benefits of Starting a Life Insurance Policy Early

Starting a life insurance policy at a young age comes with several advantages that can have a lasting impact on your financial security and peace of mind. Here are some key benefits to consider:

1. Cost Savings

- Young adults typically have lower insurance premiums due to their age and overall good health. By starting a life insurance policy early, you can lock in these lower rates for the duration of your coverage.

- As you age, the cost of life insurance tends to increase. By securing a policy early on, you can save a significant amount of money over the years compared to if you were to wait until later in life.

2. Improved Coverage

- Starting a life insurance policy early allows you to qualify for higher coverage amounts, providing greater financial protection for your loved ones in the event of your passing.

- With more coverage, you can ensure that your beneficiaries are well taken care of and can maintain their quality of life even after you're gone.

3. Long-Term Financial Security

- By investing in life insurance at a young age, you are setting yourself up for long-term financial security. The policy can act as a safety net for your loved ones, helping to cover expenses such as mortgage payments, college tuition, or other financial obligations.

- Additionally, some life insurance policies offer cash value accumulation over time, which can serve as a valuable asset in the future for things like retirement planning or emergency funds.

Tips for Young Adults to Get Affordable Life Insurance

When it comes to securing life insurance as a young adult, affordability is often a top concern. Here are some strategies to help young adults find affordable life insurance policies.

Maintain a Healthy Lifestyle

One way to potentially lower your life insurance premiums is by maintaining a healthy lifestyle. Insurers often consider factors such as your overall health, weight, and whether you smoke when determining your premium rates. By staying active, eating well, and avoiding harmful habits, you may be able to secure a more cost-effective policy.

Consider a Term Policy

Another way to make life insurance more affordable is by opting for a term policy. Term life insurance typically offers coverage for a specified period, such as 10, 20, or 30 years, and tends to have lower premiums compared to whole life insurance.

This can be a more budget-friendly option for young adults looking to protect their loved ones.

Take Advantage of Discounts and Incentives

Many insurance companies offer discounts and incentives to help make life insurance more affordable for young adults. These can include discounts for bundling policies, maintaining a good driving record, or even participating in wellness programs. Be sure to explore all available options to find ways to lower your premiums and make life insurance more cost-effective.

Conclusion

In conclusion, securing the right life insurance policy as a young adult can pave the way for long-term financial stability and peace of mind. By understanding the various aspects discussed in this guide, you can confidently navigate the realm of life insurance and make choices that align with your goals and aspirations.