High-risk life insurance providers set the stage for a compelling discussion, shedding light on the importance of this specialized type of coverage. From understanding the necessity of high-risk life insurance to navigating the challenges individuals face, this topic delves into a crucial aspect of the insurance industry.

As we delve deeper into the types of providers, factors influencing premiums, and tips for choosing the right provider, readers will gain valuable insights into this often overlooked area of insurance.

High-risk life insurance providers

High-risk life insurance is a type of insurance coverage specifically designed for individuals who are considered to be at a higher risk of premature death due to various factors. These policies are necessary as they provide financial protection to the policyholder's beneficiaries in the event of their untimely death.

Common high-risk factors

- Smoking: Individuals who smoke or have a history of smoking are often considered high-risk by insurance providers.

- Health conditions: Pre-existing health conditions such as diabetes, heart disease, or cancer can increase the risk factor.

- Occupation: Certain high-risk occupations such as firefighters, pilots, or deep-sea divers may impact insurance eligibility.

- Extreme sports: Engaging in extreme sports or activities with a high risk of injury can also affect insurance coverage.

Challenges faced by individuals

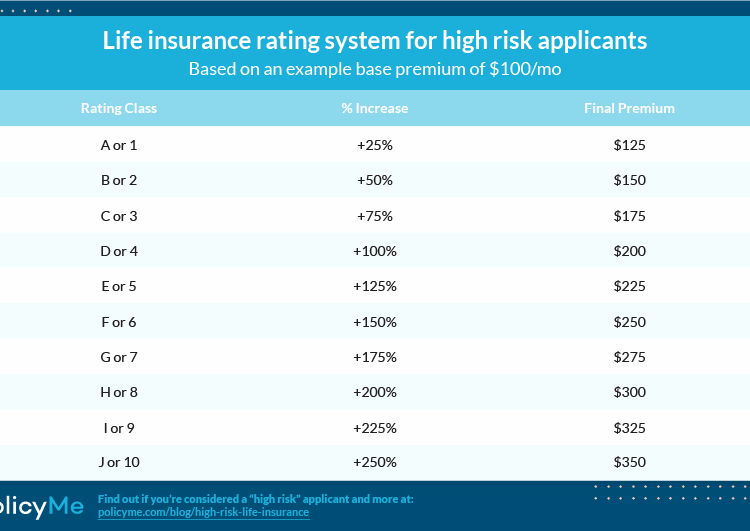

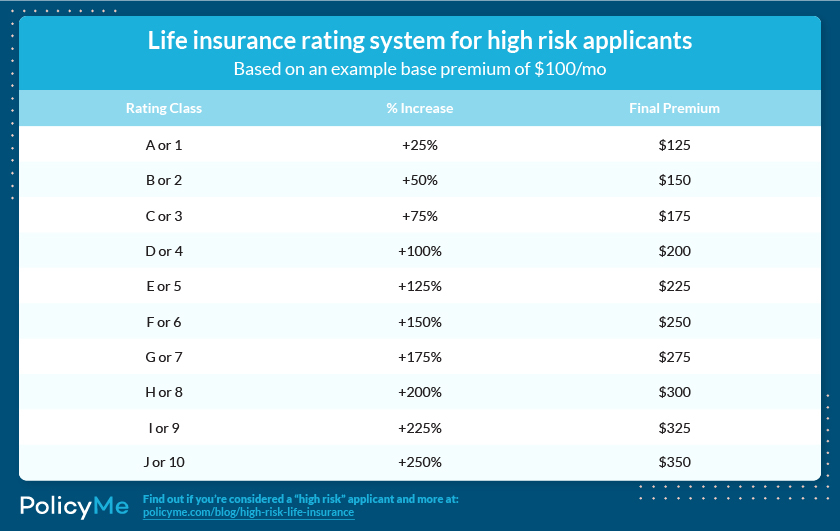

Individuals seeking high-risk life insurance coverage may encounter challenges such as higher premiums, stricter underwriting requirements, or limitations on coverage amounts. Insurance providers may also require additional medical tests or documentation to assess the level of risk accurately.

Types of high-risk life insurance providers

When it comes to high-risk life insurance providers, there are two main types: traditional insurance companies and specialized high-risk providers. Let's compare and contrast these two categories to understand the specific services they offer and the eligibility criteria for individuals seeking coverage.

Traditional Insurance Companies vs. Specialized High-Risk Providers

Traditional insurance companies typically cater to individuals with low to moderate risk profiles. They offer a wide range of life insurance products, including term life, whole life, and universal life policies. These companies often have strict underwriting guidelines and may deny coverage to individuals with pre-existing health conditions or risky lifestyles.

On the other hand, specialized high-risk providers focus on serving individuals who are considered high-risk by traditional insurers. These providers are willing to take on clients with medical issues, hazardous occupations, or risky hobbies. They offer specialized policies designed to meet the unique needs of high-risk individuals, such as guaranteed issue life insurance or simplified issue policies.

Services and Policies Offered by High-Risk Life Insurance Providers

- Specialized Underwriting: High-risk providers have expertise in underwriting policies for individuals with complex medical histories or risky lifestyles.

- Guaranteed Issue Policies: These policies do not require a medical exam and are designed for individuals who may have difficulty securing coverage elsewhere.

- Simplified Issue Policies: These policies have simplified underwriting requirements, making it easier for high-risk individuals to obtain coverage.

- High-Risk Term Life Insurance: Some providers offer term life policies specifically tailored to high-risk individuals, providing coverage for a specific term.

Eligibility Criteria for High-Risk Individuals

High-risk life insurance providers have varying eligibility criteria, but common factors that may impact eligibility include:

- Medical History: Individuals with pre-existing health conditions may be eligible for coverage with specialized underwriting.

- Occupation: High-risk occupations, such as military service or deep-sea diving, may require specialized policies.

- Lifestyle Choices: Individuals with risky hobbies or habits, such as skydiving or smoking, may need high-risk coverage.

Factors influencing high-risk life insurance premiums

When it comes to high-risk life insurance, several key factors play a significant role in determining the premium rates. These factors can include lifestyle choices, health conditions, and occupation, all of which can impact the cost of coverage.

Impact of Lifestyle Choices on Premium Costs

- Smoking: Individuals who smoke are often considered high-risk by insurance companies, leading to higher premium rates.

- Alcohol Consumption: Excessive alcohol consumption can also increase the risk profile of an individual, resulting in higher premiums.

- Participation in Extreme Sports: Engaging in high-risk activities such as skydiving or mountain climbing can lead to elevated premium costs.

Effect of Health Conditions on Premiums

- Pre-existing Medical Conditions: Individuals with chronic illnesses or pre-existing conditions may face higher premiums due to increased health risks.

- Obesity: Being overweight or obese can also impact premium rates, as it is associated with a higher likelihood of health complications.

- Family Medical History: A family history of certain diseases or conditions can influence premium costs, as it may indicate a genetic predisposition.

Influence of Occupation on Premium Rates

- Dangerous Jobs: Individuals working in high-risk occupations such as firefighting, mining, or construction may face higher premiums due to the inherent risks associated with their work.

- Frequent Travel: Jobs that require extensive travel to high-risk regions can also impact premium costs, as it exposes individuals to potential safety hazards.

- Stressful Work Environments: High-stress jobs can lead to health issues, which in turn can influence premium rates for high-risk life insurance.

Choosing the right high-risk life insurance provider

When looking for a high-risk life insurance provider, it's crucial to do thorough research and evaluation to ensure you are making the best decision for your specific needs. Here is a step-by-step guide on how to choose the right high-risk life insurance provider:

Researching Different Providers

Before making a decision, research different high-risk life insurance providers to compare their offerings. Look into their financial stability, customer reviews, and coverage options to determine which one aligns best with your requirements.

- Check the financial stability of the insurance provider to ensure they can meet their obligations in the long run.

- Read customer reviews and testimonials to get an idea of the provider's reputation and level of customer satisfaction.

- Review the coverage options offered by each provider to see if they provide the specific coverage you need for your high-risk situation.

Seeking Professional Advice

It's essential to seek professional advice when selecting a high-risk life insurance provider. An insurance agent or financial advisor can help you navigate the complexities of high-risk insurance and guide you towards the best options for your unique circumstances.

Professional advice can provide valuable insights and recommendations based on your individual needs and risk profile.

Ending Remarks

In conclusion, high-risk life insurance providers play a vital role in ensuring individuals with unique circumstances can access the coverage they need. By understanding the intricacies of this sector and making informed decisions, individuals can secure suitable protection for themselves and their loved ones.