Diving into the realm of Whole life insurance quotes, this introduction sets the stage for an illuminating discussion on the intricacies of securing the right coverage.

The subsequent paragraph will offer a comprehensive overview of the topic, shedding light on its importance and relevance.

Overview of Whole Life Insurance Quotes

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which covers a specific period, whole life insurance offers lifelong protection as long as premiums are paid.Getting quotes for whole life insurance is significant as it helps individuals understand the cost associated with this type of coverage.

By comparing quotes from different insurance providers, individuals can make an informed decision based on their budget and coverage needs.

Factors Influencing Whole Life Insurance Quotes

- Age of the insured: Younger individuals typically receive lower quotes as they are considered lower risk.

- Health status: Healthier individuals may qualify for better rates compared to those with pre-existing medical conditions.

- Coverage amount: The higher the coverage amount, the higher the premiums.

- Cash value component: Whole life insurance policies with a cash value component may have higher premiums.

- Insurance company: Different insurance providers may offer varying quotes based on their underwriting criteria.

Obtaining Whole Life Insurance Quotes

When it comes to getting whole life insurance quotes, the process can be straightforward if you know what steps to take. Here is a guide on how to obtain whole life insurance quotes online and tips for effectively comparing them.

Step-by-Step Guide to Getting Whole Life Insurance Quotes Online

- Start by researching reputable insurance companies that offer whole life insurance policies.

- Visit the websites of these insurance companies and look for their online quote tools.

- Fill out the required information accurately, including your age, gender, health history, and coverage needs.

- Submit the online form and wait for the insurance company to provide you with a whole life insurance quote.

- Repeat the process for multiple insurance companies to compare quotes and find the best coverage for your needs.

Tips for Comparing Different Whole Life Insurance Quotes Effectively

- Ensure you are comparing similar coverage amounts and policy terms when evaluating quotes.

- Look beyond the premium cost and consider other factors like cash value accumulation, dividends, and riders offered.

- Check the financial strength and reputation of the insurance company to ensure they can fulfill their obligations in the long run.

- Read the fine print of each policy to understand any exclusions, limitations, or additional fees that may apply.

- Consider seeking guidance from a financial advisor or insurance agent to help you navigate the complexities of whole life insurance policies.

The Importance of Accuracy When Providing Information for Accurate Quotes

Accurate information is crucial when obtaining whole life insurance quotes. Insurance companies use the details you provide to assess your risk profile and determine the cost of coverage. Inaccurate or misleading information could result in inaccurate quotes, leading to potential issues when securing coverage.

Be honest and thorough when filling out online forms to ensure you receive the most precise quotes tailored to your individual circumstances.

Factors Affecting Whole Life Insurance Quotes

When it comes to determining the cost of whole life insurance quotes, several factors come into play. These factors can significantly impact the premiums you will pay for your policy.

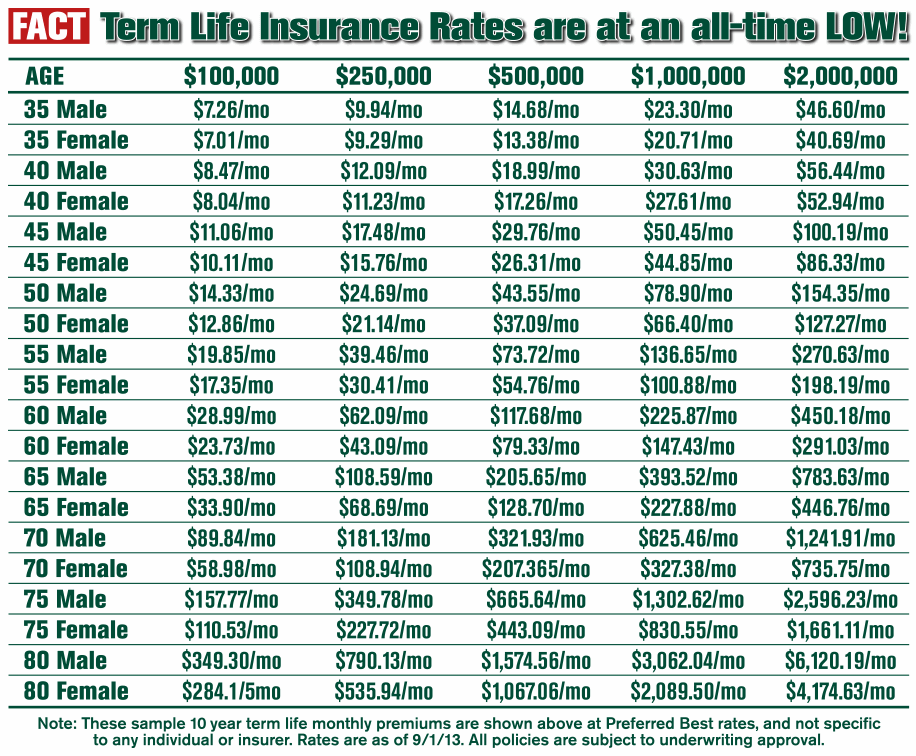

Age and Health

Age and health are two major factors that influence the cost of whole life insurance quotes. Generally, the younger and healthier you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk and are less likely to develop health issues that could impact their life expectancy.

Coverage Amount and Policy Features

The coverage amount and policy features you choose will also affect the cost of your whole life insurance quotes. Opting for a higher coverage amount or adding on additional features, such as riders for critical illness or disability coverage, will increase your premiums.

It's important to carefully consider your coverage needs and budget when selecting these options.

Lifestyle Choices

Your lifestyle choices can have a significant impact on the quotes you receive for whole life insurance. Factors such as smoking, excessive alcohol consumption, or participation in risky activities like skydiving can result in higher premiums. Insurers assess these lifestyle factors to determine the level of risk you pose as a policyholder.

Understanding Whole Life Insurance Costs

When it comes to whole life insurance, understanding the costs involved is crucial for making informed decisions. Let's break down the components that make up a whole life insurance quote and explore the concept of premiums, cash value, and death benefits in relation to costs.

We will also compare the cost structure of whole life insurance with term life insurance.

Components of Whole Life Insurance Quote

- Premiums: These are the regular payments you make to the insurance company to keep your policy active. Premiums for whole life insurance are typically higher than term life insurance due to the lifelong coverage and cash value component.

- Cash Value: Whole life insurance policies have a cash value component that grows over time. This cash value can be accessed through loans or withdrawals, but it also affects the overall cost of the policy.

- Death Benefits: The death benefit is the amount paid out to your beneficiaries upon your passing. The cost of the death benefit is included in the overall cost of the policy.

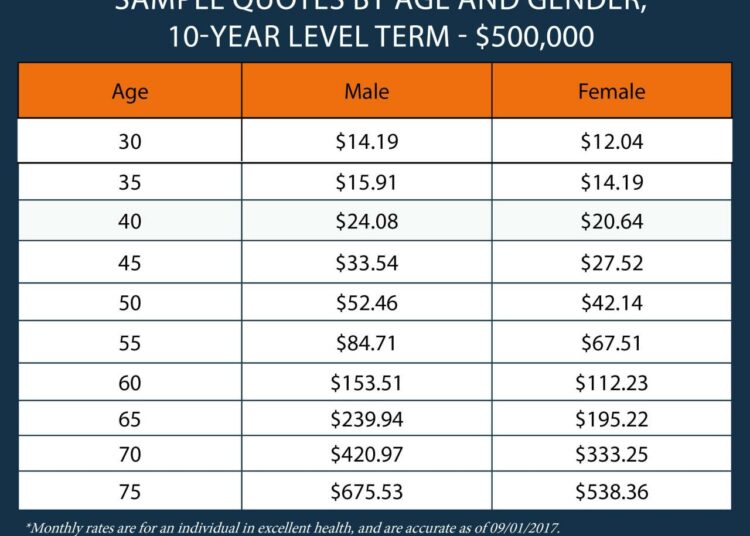

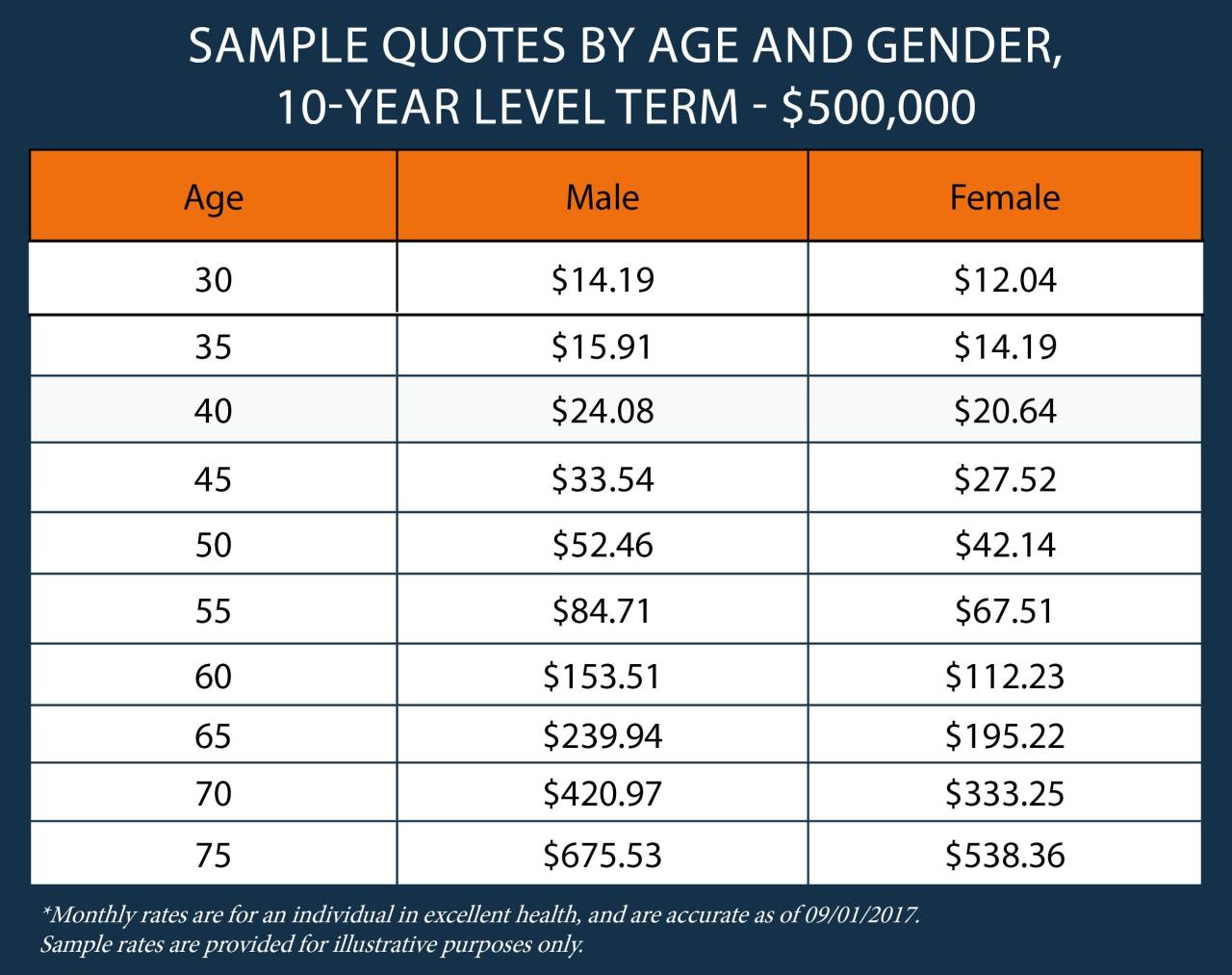

Comparison with Term Life Insurance

- Whole life insurance generally has higher premiums compared to term life insurance due to the lifelong coverage and cash value component.

- Term life insurance offers coverage for a specific term, usually 10, 20, or 30 years, with lower premiums but no cash value accumulation.

- While term life insurance is more affordable in the short term, whole life insurance provides lifelong coverage and the potential for cash value growth, making it a more expensive option.

Concluding Remarks

In conclusion, this discussion encapsulates the key points surrounding Whole life insurance quotes, leaving readers with a deeper understanding of this critical aspect of financial planning.