Best corporate insurance policies set the foundation for protecting businesses against unforeseen risks and uncertainties. This comprehensive guide delves into the world of corporate insurance, offering insights and valuable information to help businesses make informed decisions in safeguarding their operations.

From understanding the importance of corporate insurance to exploring different types of policies and best practices for management, this guide covers it all with a casual formal language style.

Importance of Corporate Insurance Policies

Corporate insurance policies play a crucial role in safeguarding businesses from unexpected risks and uncertainties. These policies provide a safety net for companies, ensuring financial protection and continuity in times of crisis.

Protection Against Liability

One of the key benefits of corporate insurance policies is the protection they offer against liability claims. In the event of accidents, injuries, or property damage, these policies can cover legal expenses and compensation costs, shielding the business from potential financial ruin.

Risk Mitigation

Corporate insurance policies help mitigate various risks that businesses face on a daily basis. Whether it's property damage, theft, natural disasters, or cyber-attacks, having the right insurance coverage can minimize the impact of these unforeseen events on the company's operations and bottom line.

Business Continuity

By having comprehensive insurance policies in place, businesses can ensure continuity even in the face of adversity. Whether it's a lawsuit, a natural disaster, or a pandemic, these policies provide the financial support needed to keep the business afloat and resume operations as quickly as possible.

Example: Worker's Compensation Coverage

One example of how corporate insurance policies have helped businesses in the past is through worker's compensation coverage. In cases of employee injuries or illnesses sustained on the job, this type of insurance can cover medical expenses and lost wages, protecting both the employee and the employer from financial hardships.

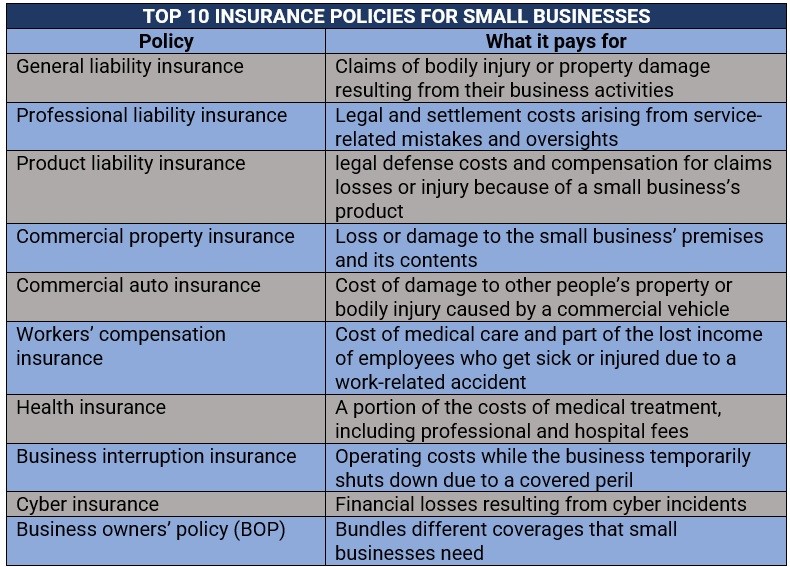

Types of Corporate Insurance Policies

When it comes to protecting your business, there are various types of corporate insurance policies available in the market. Each type serves a specific purpose and offers different coverage options tailored to meet the needs of different businesses.

General Liability Insurance

General liability insurance is essential for all businesses, as it provides coverage for third-party claims of bodily injury, property damage, and advertising injury. This type of policy protects your business from lawsuits and helps cover legal fees and settlement costs.

Property Insurance

Property insurance is designed to protect your business assets, including buildings, equipment, inventory, and furniture, from risks such as fire, theft, vandalism, and natural disasters. This policy ensures that your business can recover quickly in the event of property damage or loss.

Cyber Insurance

In today's digital age, cyber insurance is becoming increasingly important for businesses that handle sensitive customer data or rely on computer systems for their operations. This type of policy helps cover the costs associated with data breaches, cyber-attacks, and other cyber threats.

It is crucial for businesses to tailor their insurance coverage to specific needs to ensure adequate protection. By understanding the key features and benefits of each type of corporate insurance policy, companies can make informed decisions to safeguard their assets and mitigate risks effectively.

Factors to Consider When Choosing Corporate Insurance Policies

When selecting insurance policies for their business, there are several key factors that companies should take into consideration to ensure they are adequately protected in case of unforeseen events.

Coverage Limits

- It is essential to evaluate the coverage limits offered by different insurance policies to make sure they align with the specific needs and risks of the business.

- Understanding the maximum amount that the insurance company will pay in the event of a claim is crucial to avoid being underinsured.

- Consider factors such as property value, liability risks, and business interruption costs when determining appropriate coverage limits.

Deductibles

- Deductibles represent the amount that the insured must pay out of pocket before the insurance coverage kicks in.

- Choosing higher deductibles can lead to lower premium costs but may require the business to cover more expenses in the event of a claim.

- Conversely, lower deductibles result in higher premiums but reduce the financial burden on the business when making a claim.

Exclusions

- Exclusions are specific risks or events that are not covered by the insurance policy.

- Businesses should carefully review the exclusions listed in the policy to understand what is not covered and assess whether additional coverage is needed.

- Being aware of exclusions can help avoid surprises when filing a claim and ensure comprehensive protection for the business.

Role of Insurance Agents or Brokers

- Insurance agents or brokers play a crucial role in helping businesses navigate the complex landscape of insurance options.

- They can provide expert advice on the most suitable policies based on the company's industry, size, and risk profile.

- Insurance professionals can assist in comparing quotes, explaining policy terms, and advocating for the business in case of disputes with the insurance provider.

Best Practices for Managing Corporate Insurance Policies

Managing corporate insurance policies effectively is crucial for safeguarding a business's assets and operations. Here are some best practices to ensure your insurance policies are up to date and provide adequate coverage.

Regular Policy Reviews and Updates

Regularly reviewing and updating your corporate insurance policies is essential to keep up with changes in your business operations, industry regulations, and potential risks. Here are some key steps to follow:

- Evaluate your current coverage and assess if it aligns with your business needs and risks.

- Review policy exclusions and limitations to ensure you have comprehensive coverage.

- Stay informed about industry trends and legal requirements that may impact your insurance needs.

- Work with an experienced insurance broker or advisor to identify gaps in coverage and explore new insurance options.

Mitigating Insurance Risks and Ensuring Adequate Coverage

Aside from regular reviews and updates, there are additional steps you can take to manage insurance risks effectively and ensure your business is adequately protected:

- Implement risk management strategies to reduce the likelihood of insurance claims and losses.

- Consider purchasing umbrella or excess liability insurance to provide additional coverage beyond your primary policies.

- Conduct a thorough assessment of your business assets and liabilities to determine the appropriate coverage limits.

- Create a contingency plan for handling insurance claims and emergencies to minimize disruptions to your business operations.

Ultimate Conclusion

In conclusion, navigating the realm of corporate insurance policies can be complex, but with the right knowledge and guidance, businesses can secure robust protection for their ventures. By implementing best practices and staying informed about the latest trends, companies can effectively manage their insurance needs and mitigate potential risks.