How QuickBooks Self Employed Can Simplify Freelancer Taxes sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

QuickBooks Self Employed is a powerful tool that simplifies tax management for freelancers, making the daunting task of tax preparation more manageable and efficient. In this article, we will explore how this software caters to the unique needs of freelancers and streamlines the process of tracking income, managing expenses, and preparing taxes.

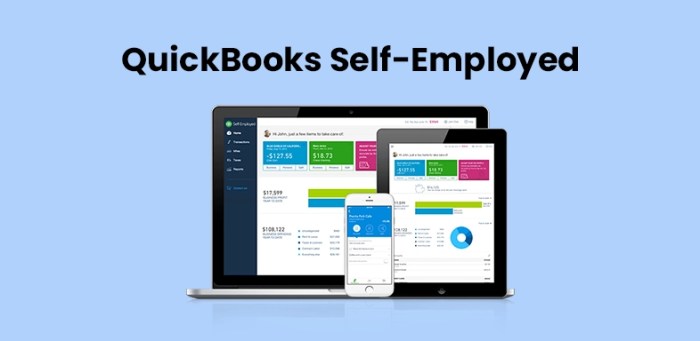

Overview of QuickBooks Self Employed

QuickBooks Self Employed is an accounting software designed specifically for freelancers and independent contractors to simplify their financial management. It offers a range of features tailored to meet the unique needs of self-employed individuals.

Features of QuickBooks Self Employed

- Tracking income and expenses: QuickBooks Self Employed allows freelancers to easily track their earnings and expenses in one place, making it simple to monitor their cash flow.

- Invoicing and payment tracking: Freelancers can create and send professional invoices to clients and keep track of payments received, helping them stay organized and on top of their billing.

- Mileage tracking: The software helps freelancers log their mileage for business trips, which can be crucial for tax deductions and reimbursements.

- Tax preparation: QuickBooks Self Employed simplifies tax preparation by categorizing expenses, calculating deductions, and generating reports that can be easily shared with accountants or tax professionals.

Importance of Using Accounting Software for Freelancer Taxes

Utilizing accounting software like QuickBooks Self Employed is essential for freelancers when it comes to managing their taxes efficiently. Here's why:

- Accuracy: By tracking income, expenses, and deductions throughout the year, freelancers can ensure accurate tax filings and avoid errors that could lead to penalties or audits.

- Time-saving: Automating financial tasks with software saves freelancers time that can be better spent on their core business activities, rather than struggling with manual bookkeeping.

- Organization: Having all financial data in one place helps freelancers stay organized and easily access the information they need when filing taxes or responding to inquiries from tax authorities.

Simplifying Income Tracking

Tracking income is crucial for freelancers to manage their finances efficiently and prepare for taxes accurately. QuickBooks Self Employed provides tools and features to simplify income tracking, making it easier for freelancers to stay organized and compliant.

Automated Income Import

QuickBooks Self Employed allows freelancers to connect their bank accounts and credit cards to automatically import income transactions. This eliminates the need for manual entry and ensures all income is accurately recorded in one place.

Categorization of Income

Freelancers can categorize their income transactions in QuickBooks Self Employed based on different sources or clients. This categorization helps in identifying which income is taxable and provides a clear breakdown for tax reporting purposes.

Real-Time Income Insights

With real-time income insights, freelancers can track their earnings throughout the year and monitor their financial progress. This feature helps in estimating tax liabilities and budgeting for future expenses.

Better Tax Preparation

By simplifying income tracking, QuickBooks Self Employed streamlines the tax preparation process for freelancers. Accurate income records make it easier to calculate deductions, report income on tax returns, and avoid any discrepancies with tax authorities.

Expense Management with QuickBooks Self Employed

Managing expenses is a crucial aspect of freelance work, as it directly impacts your bottom line. QuickBooks Self Employed offers a streamlined solution for freelancers to track and categorize their expenses efficiently.

Categorizing Expenses in QuickBooks Self Employed

- When you incur a business expense, simply input the details into the QuickBooks Self Employed app or software.

- Assign each expense to the appropriate category, such as office supplies, travel, meals, or utilities.

- QuickBooks Self Employed provides predefined categories, but you can also create custom categories to suit your specific business needs.

- By categorizing expenses accurately, you can generate detailed reports that give you a clear picture of your spending habits and financial health.

Maximizing Tax Deductions through Expense Management

- Properly categorizing expenses is essential for maximizing tax deductions as a freelancer.

- By keeping track of all your business expenses in QuickBooks Self Employed, you ensure that you don't miss out on any potential deductions.

- Expense reports generated by the software can be used to support your tax deductions and provide a comprehensive overview of your deductible expenses.

- With accurate expense management, you can minimize your tax liability and keep more of your hard-earned money in your pocket.

Tax Preparation and Filing

When it comes to tax preparation and filing, QuickBooks Self Employed offers valuable tools and features to simplify the process for freelancers. From organizing tax-related documents to streamlining the filing process, this software can be a game-changer for managing your taxes efficiently.

Organizing Tax-Related Documents

One of the key benefits of using QuickBooks Self Employed for tax preparation is its ability to help you organize all your tax-related documents in one place. By syncing your bank accounts and tracking your income and expenses throughout the year, you can easily access all the necessary information when it's time to file your taxes.

- Upload and categorize receipts: Quickly capture and categorize receipts using the mobile app, ensuring you have all the necessary documentation for deductions.

- Track mileage: Keep track of your business mileage automatically, making it easier to claim deductions for vehicle expenses.

- Generate reports: Create detailed reports of your income and expenses, making it simple to review your financial data before filing taxes.

Ease of Filing Taxes

With all your financial information organized and easily accessible in QuickBooks Self Employed, filing taxes becomes a much smoother process. The software can help you calculate your tax obligations, identify potential deductions, and even integrate with tax filing services to submit your returns seamlessly.

By using QuickBooks Self Employed, freelancers can save time and reduce the stress of tax season by having all their financial data in one place.

Conclusive Thoughts

In conclusion, QuickBooks Self Employed emerges as a game-changer for freelancers when it comes to tax management. By offering a user-friendly platform that automates crucial financial tasks, freelancers can focus more on their work and less on tax-related stress. With its intuitive features and seamless integration, QuickBooks Self Employed truly simplifies freelancer taxes and paves the way for a more organized and stress-free financial future.

Q&A

How does QuickBooks Self Employed help freelancers track income efficiently?

QuickBooks Self Employed allows freelancers to connect their bank accounts and credit cards to automatically track income. This feature eliminates the need for manual entry and ensures accurate income records.

Can QuickBooks Self Employed categorize expenses for tax deductions?

Yes, QuickBooks Self Employed enables freelancers to categorize expenses into different tax-deductible categories, making it easier to maximize deductions and minimize taxable income.

Is QuickBooks Self Employed suitable for filing taxes directly?

While QuickBooks Self Employed aids in tax preparation by organizing documents and providing relevant reports, it is recommended to review the information with a tax professional before filing taxes directly through the software.