Auto Policy Quotes: What Every Driver Should Know Before Buying sets the stage for this informative guide, offering readers valuable insights into the world of auto insurance with a focus on key considerations every driver should be aware of.

The following paragraphs delve into the essential aspects of understanding auto policy quotes, coverage options, discounts and savings, as well as policy exclusions and limitations to equip you with the knowledge needed to make informed decisions.

Understanding Auto Policy Quotes

When looking for auto insurance, it is essential to understand the different components of auto policy quotes to make an informed decision. Here are some key points to consider:

Key Components of Auto Policy Quotes

- Liability Coverage: This covers costs associated with bodily injury and property damage that you are legally responsible for.

- Comprehensive Coverage: This protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: This covers damages to your vehicle in the event of a collision with another vehicle or object.

- Personal Injury Protection (PIP): This helps cover medical expenses for you and your passengers in case of an accident, regardless of fault.

Factors Influencing the Cost of Auto Insurance

- Driving Record: A clean driving record typically means lower premiums, as it indicates lower risk.

- Vehicle Type: The make, model, and age of your vehicle can impact insurance costs.

- Location: Urban areas with higher rates of accidents or theft may result in higher premiums.

- Coverage Limits: Higher coverage limits will lead to higher premiums but provide more protection.

Importance of Comparing Policy Quotes

- By comparing quotes from different providers, you can find the best coverage at the most competitive price.

- Each insurance company weighs factors differently, so getting multiple quotes can help you find the best fit for your needs.

Tips for Reading and Interpreting Auto Policy Quotes

- Pay attention to coverage limits, deductibles, and exclusions to understand what is and isn’t covered by the policy.

- Look for any discounts or additional benefits offered by the insurance company to maximize savings.

- Consider the overall cost of the policy, including premiums, deductibles, and any potential out-of-pocket expenses.

Coverage Options

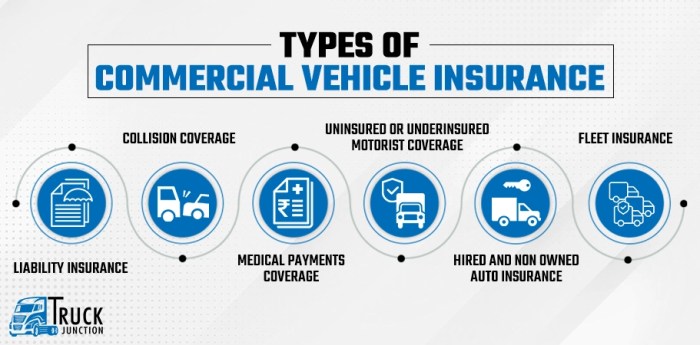

When considering auto policy quotes, it is crucial to understand the different coverage options available to ensure you have adequate protection in case of an accident or other unexpected events. Let’s explore the common types of coverage included in auto policy quotes and their significance for drivers.

Comprehensive Coverage vs. Collision Coverage

- Comprehensive Coverage: This type of coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage, on the other hand, helps cover the cost of repairs to your vehicle in the event of a collision with another vehicle or object.

Significance of Liability Coverage

- Liability Coverage: Liability coverage is essential as it helps protect you financially if you are found at fault in an accident that causes injury or property damage to others. This coverage can help cover medical bills, property damage, legal fees, and more.

Benefits of Adding Optional Coverage

- Optional Coverage: In addition to the basic coverage options, there are several optional coverages you can add to your auto policy for added protection. This may include uninsured/underinsured motorist coverage, medical payments coverage, roadside assistance, rental car reimbursement, and more.

Adding these optional coverages can provide you with peace of mind and additional financial protection in various situations.

Discounts and Savings

When it comes to auto insurance, finding ways to save money on premiums is always a top priority for drivers. One of the most effective ways to lower your insurance costs is by taking advantage of available discounts offered by insurance providers.

By understanding the various discounts that are available, you can maximize your savings and get the best deal on your auto policy.

Potential Discounts to Lower Auto Insurance Premiums

- Good Driver Discount: Insurance companies often reward drivers with a safe driving history by offering discounts for maintaining a clean driving record.

- Multi-Policy Discount: Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings.

- Good Student Discount: Students who maintain good grades in school may qualify for a discount on their auto insurance premiums.

- Low Mileage Discount: If you drive fewer miles than the average driver, you may be eligible for a discount on your insurance premiums.

- Safety Features Discount: Vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices may qualify for discounts.

Maximizing Discounts for the Best Deal

- Ask About Available Discounts: When obtaining quotes for auto insurance policies, be sure to inquire about any discounts that you may qualify for. Different insurance companies offer different discounts, so it’s essential to compare options to maximize savings.

- Bundle Policies: Consider bundling your auto insurance with other policies from the same provider to take advantage of multi-policy discounts.

- Maintain a Safe Driving Record: By practicing safe driving habits and avoiding accidents and traffic violations, you can qualify for discounts on your auto insurance premiums.

- Shop Around: Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal on coverage that meets your needs.

Policy Exclusions and Limitations

When purchasing an auto insurance policy, it is crucial to understand the exclusions and limitations that may impact your coverage. By being aware of these factors, you can avoid any surprises in the event of a claim and ensure that you have the protection you need.Exclusions are specific situations or circumstances that are not covered by your auto insurance policy.

Understanding these exclusions is essential to avoid any gaps in coverage. Some common exclusions found in auto insurance policies include:

Common Exclusions in Auto Insurance Policies

- Intentional acts or fraud

- Racing or using the vehicle for commercial purposes

- Driving under the influence of drugs or alcohol

- Damage from normal wear and tear

Limitations, on the other hand, refer to the maximum amount your insurer will pay for a particular type of claim. It is important to be aware of these limitations to ensure you have adequate coverage in place. Examples of limitations in standard auto insurance policies include:

Limitations of Coverage in Standard Auto Policies

- Maximum payout for medical expenses

- Maximum coverage for property damage

- Limitations on rental car coverage

It is crucial to carefully review the exclusions and limitations of your auto insurance policy before making a purchase. Failure to do so could leave you vulnerable to unexpected costs in the event of a claim. By understanding these factors upfront, you can make an informed decision and ensure that you have the right coverage for your needs.

Ending Remarks

In conclusion, Auto Policy Quotes: What Every Driver Should Know Before Buying serves as a comprehensive resource for those navigating the complexities of purchasing auto insurance, empowering individuals to secure suitable coverage tailored to their needs.

Clarifying Questions

What factors influence the cost of auto insurance?

The cost of auto insurance is influenced by factors such as the driver’s age, driving record, type of vehicle, coverage limits, and location.

How can I maximize discounts on auto insurance?

To maximize discounts, drivers can maintain a clean driving record, bundle policies, inquire about available discounts, and compare quotes from multiple providers.

What are common exclusions in auto insurance policies?

Common exclusions in auto insurance policies may include coverage for intentional acts, racing, using a vehicle for commercial purposes, and driving under the influence.