In the realm of financial security, the quest for the best income protection insurance companies becomes paramount. Delve into this guide that not only enlightens but also empowers individuals to make informed decisions in safeguarding their income.

As we navigate through the intricate world of income protection insurance, understanding its nuances and benefits is crucial for securing a stable financial future.

Introduction to Income Protection Insurance

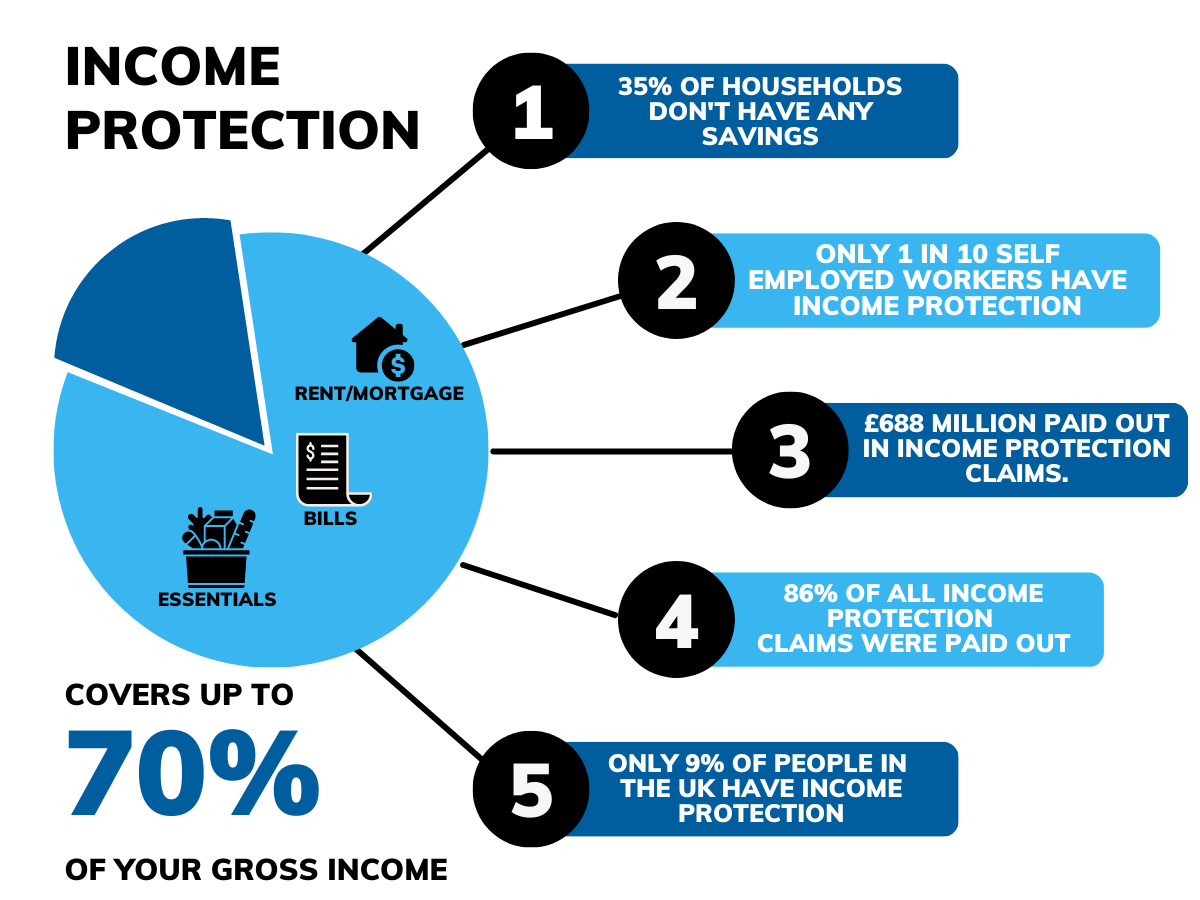

Income protection insurance is a type of coverage that provides financial support in the event that you are unable to work due to illness or injury. This insurance ensures that you continue to receive a portion of your income until you are able to return to work or retire.

It is an important safety net that can help you maintain your standard of living and cover essential expenses during challenging times.

Benefits of Having Income Protection Insurance

- Financial Security: Income protection insurance provides a regular income stream when you are unable to work, helping you cover your bills and living expenses.

- Peace of Mind: Knowing that you have a financial safety net in place can reduce stress and anxiety during difficult times.

- Flexible Coverage: Policies can be tailored to your specific needs, ensuring that you receive the right level of support based on your income and circumstances.

Examples of Situations Where Income Protection Insurance Can Be Beneficial

- Accidents: If you are injured in an accident and unable to work for an extended period, income protection insurance can help cover your lost income.

- Illness: In the case of a serious illness that prevents you from working, this insurance can provide financial support until you are able to return to your job.

- Disability: If you become permanently disabled and can no longer work, income protection insurance can help you maintain your financial stability.

Factors to Consider When Choosing an Income Protection Insurance Company

When selecting an income protection insurance company, there are several key factors to consider to ensure you get the best coverage for your needs. It's important to compare the coverage options offered by different companies and to carefully read the fine print in insurance policies to understand the terms and conditions.

Coverage Options

- Look for a company that offers a wide range of coverage options, including coverage for both short-term and long-term disabilities.

- Consider whether the policy covers partial disability, as this can be important if you are only able to work part-time due to an injury or illness.

- Check if the policy includes coverage for mental health conditions, as these are becoming increasingly common reasons for disability claims.

Financial Strength and Reputation

- Research the financial strength and stability of the insurance company to ensure they will be able to fulfill their obligations in the event of a claim.

- Read reviews and check the reputation of the company to see how they handle claims and customer service.

- Consider choosing a company with a good track record of paying claims promptly and fairly.

Premiums and Policy Features

- Compare premiums from different companies to find a policy that offers the best value for the coverage provided.

- Look for policy features such as a guaranteed renewable policy, which ensures you can renew your coverage without undergoing medical underwriting.

- Consider any additional riders or benefits that may be offered, such as a return of premium rider or a cost of living adjustment rider.

Exclusions and Limitations

- Pay close attention to the exclusions and limitations in the policy, as these can vary between companies and may impact your ability to make a claim.

- Understand any waiting periods or elimination periods that may apply before benefits are paid out, as these can affect when you start receiving income replacement.

- Be aware of any pre-existing conditions that may not be covered under the policy, as this could impact your eligibility for benefits.

Top Features to Look for in Income Protection Insurance Companies

When choosing an income protection insurance policy, it is crucial to consider certain key features that can greatly impact the coverage and benefits you receive. Here are some essential features to look for in income protection insurance policies:

Waiting Periods and Benefit Periods

One of the most critical features to consider in income protection insurance is the waiting period and benefit period. The waiting period refers to the time you must wait after becoming disabled before you start receiving benefits. A shorter waiting period means you can start receiving benefits sooner, but it may come with higher premiums.

The benefit period, on the other hand, determines how long you will receive benefits once your claim is approved. It is important to choose a benefit period that aligns with your financial needs and obligations.

Types of Disabilities Covered

Another important feature to look for is the types of disabilities covered by the income protection insurance policy. Make sure to carefully review the policy to understand what specific disabilities are covered and under what circumstances. Some policies may have restrictions or exclusions for certain types of disabilities, so it is essential to choose a policy that provides comprehensive coverage for a wide range of disabilities.

Comparison of the Best Income Protection Insurance Companies

When it comes to choosing the best income protection insurance company, it's essential to compare various factors such as coverage, premiums, waiting periods, and customer reviews. Below is a table highlighting the strengths and weaknesses of some of the top income protection insurance companies, along with real-life examples of individuals who have benefited from their policies.

Top Income Protection Insurance Companies Comparison

| Insurance Company | Coverage | Premiums | Waiting Periods | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Company A | Comprehensive coverage for various illnesses and injuries | Competitive premiums based on age and occupation | Short waiting periods for claims processing | Excellent customer service and easy claims process | Higher premiums for certain high-risk occupations |

| Company B | Flexible coverage options with add-ons for specific needs | Fixed premiums for the duration of the policy | Longer waiting periods but with higher coverage limits | Strong financial stability and reputation in the industry | Complex policy terms and conditions |

| Company C | Basic coverage for common illnesses and injuries | Affordable premiums suitable for budget-conscious individuals | Varying waiting periods depending on the type of claim | User-friendly online platform for policy management | Limited coverage options compared to other insurers |

Wrap-Up

Concluding our exploration of the best income protection insurance companies, it becomes evident that the right choice can truly make a difference in times of need. By prioritizing financial security through a reputable insurance provider, individuals can confidently face the uncertainties that lie ahead.