Exploring the realm of Best no-exam life insurance policy, this guide invites readers into a world of valuable insights and expert knowledge. Dive into the nuances of this specialized insurance option and discover everything you need to know to make an informed decision.

Delve into the specifics of different policies, understand the benefits, and navigate through the potential pitfalls with ease.

Introduction to No-Exam Life Insurance Policies

A no-exam life insurance policy is a type of life insurance that allows individuals to secure coverage without the need for a medical exam. This means that applicants can skip the traditional medical underwriting process, making it a quicker and more convenient option for obtaining life insurance.

Benefits of Opting for a No-Exam Life Insurance Policy

- Quick Approval: No-exam life insurance policies typically have faster approval times compared to traditional policies that require a medical exam.

- Convenience: By eliminating the need for a medical exam, applicants can avoid the hassle of scheduling appointments and undergoing tests.

- Privacy: Since no medical exam is required, individuals can maintain their privacy and confidentiality throughout the application process.

Eligibility Criteria for Obtaining a No-Exam Life Insurance Policy

While the eligibility criteria may vary depending on the insurance provider, common requirements for obtaining a no-exam life insurance policy include being within a certain age range, being in relatively good health, and not having any serious pre-existing medical conditions.

Types of No-Exam Life Insurance Policies Available in the Market

| Policy Type | Description |

|---|---|

| Simplified Issue Life Insurance | This type of policy requires applicants to answer a series of health-related questions but does not involve a medical exam. |

| Guaranteed Issue Life Insurance | With guaranteed issue policies, applicants are typically guaranteed approval regardless of their health status, making it ideal for individuals with pre-existing conditions. |

Pros and Cons of No-Exam Life Insurance Policies

When considering life insurance options, it's essential to weigh the advantages and disadvantages of choosing a no-exam life insurance policy.

Advantages of Choosing a No-Exam Life Insurance Policy

- No medical exam required: One of the primary benefits of a no-exam life insurance policy is that you can secure coverage without undergoing a medical examination. This can be a convenient option for individuals who have health issues or those who prefer to skip the medical tests.

- Quick approval process: Since there is no need for a medical exam, the approval process for a no-exam life insurance policy is typically faster compared to traditional policies. This means you can get coverage in place sooner, providing peace of mind for you and your loved ones.

- Accessible to people with health concerns: No-exam life insurance policies may be more accessible to individuals with pre-existing health conditions or those who have difficulty obtaining traditional life insurance due to their health status. This type of policy can offer a solution for those who might otherwise struggle to get insured.

Drawbacks of No-Exam Life Insurance Policies

- Higher premiums: Since the insurance company takes on more risk by not conducting a medical exam, the premiums for a no-exam life insurance policy are typically higher than those for traditional policies. This means you may end up paying more for coverage in the long run.

- Limited coverage amounts: No-exam life insurance policies often come with lower coverage amounts compared to traditional policies. If you require a substantial amount of coverage, a no-exam policy may not meet your needs adequately.

- Restrictions on policy options: Some insurance providers may offer limited policy options for their no-exam life insurance products, which could restrict your ability to customize your coverage to suit your specific needs and preferences.

Comparison with Traditional Life Insurance Policies

- Medical exam requirement: Traditional life insurance policies typically require a thorough medical examination to assess your health and determine your premium rates. In contrast, no-exam life insurance policies skip this step, making them a quicker and more convenient option for some individuals.

- Premium costs: While traditional life insurance policies may offer lower premium rates for individuals in good health, those with pre-existing conditions or who are older may find that the premiums for a no-exam policy are more affordable due to the lack of a medical exam requirement.

- Coverage options: Traditional life insurance policies often provide a wider range of coverage options and policy features compared to their no-exam counterparts. If you are looking for more flexibility and customization in your coverage, a traditional policy may be the better choice.

Factors to Consider When Choosing the Best No-Exam Life Insurance Policy

When choosing a no-exam life insurance policy, there are several key factors to consider to ensure you select the best option for your needs. Understanding how coverage amounts are determined, the role of premiums, and the importance of reading the fine print are crucial in making an informed decision.

Determining Coverage Amount

- Insurance Needs: Assess your financial obligations, such as mortgage payments, debts, and future expenses, to determine the appropriate coverage amount.

- Income Replacement: Consider how much income your family would need in the event of your passing to maintain their standard of living.

- Final Expenses: Account for funeral costs, medical bills, and any outstanding debts that your loved ones may be responsible for.

Role of Premiums

- Premium Affordability: Choose a premium amount that fits within your budget to ensure you can maintain the policy over the long term.

- Level of Coverage: Understand how premiums may vary based on the coverage amount and term length selected.

- Payment Frequency: Determine whether monthly, quarterly, or annual premium payments align with your financial goals and preferences.

Reading the Fine Print

- Policy Details: Review the terms and conditions of the policy to understand coverage limitations, exclusions, and any additional benefits or riders offered.

- Policy Renewal: Clarify how and when the policy can be renewed, as well as any changes in premiums or coverage that may occur over time.

- Claims Process: Familiarize yourself with the procedures for filing a claim and the documentation required to ensure a smooth claims experience for your beneficiaries.

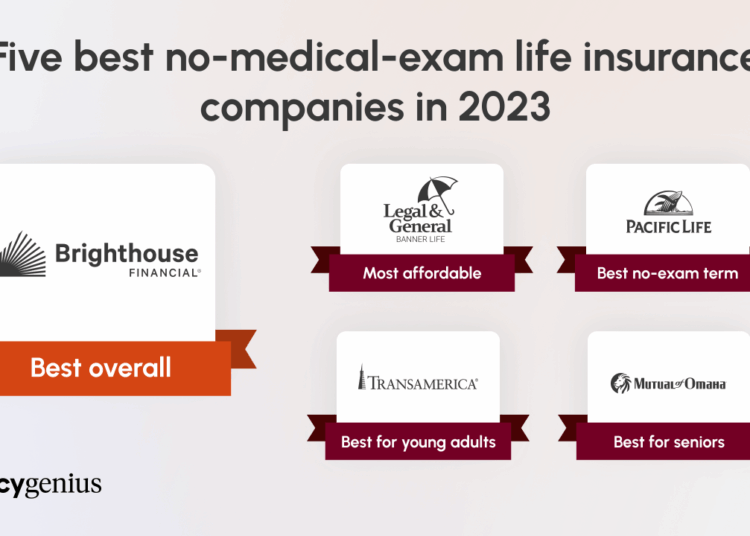

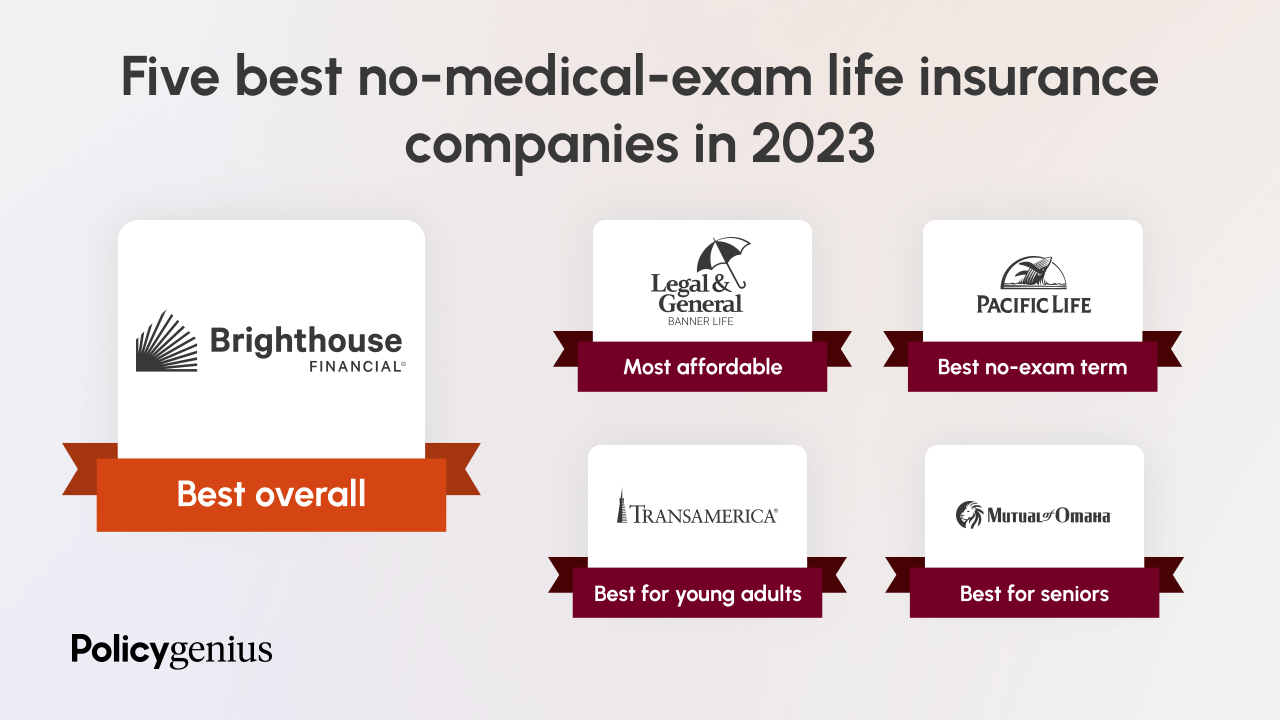

Top Providers Offering No-Exam Life Insurance Policies

When it comes to choosing a no-exam life insurance policy, it's important to consider the reputation and offerings of the insurance companies. Here are some of the best insurance providers that offer no-exam life insurance policies:

ABC Insurance Company

ABC Insurance Company is known for its hassle-free application process and quick approval times for their no-exam life insurance policies. They offer competitive rates and excellent customer service, making them a top choice for many customers.

XYZ Insurance Company

XYZ Insurance Company stands out for their customizable coverage options and flexible payment plans for their no-exam life insurance policies. Customers appreciate their transparency and dedication to meeting their individual needs.

123 Insurance Company

Insurance Company is praised for their innovative online platform that allows customers to easily apply for and manage their no-exam life insurance policy. Their user-friendly interface and efficient claims process have earned them a loyal customer base.Overall, these top providers offer a range of benefits and features that cater to different preferences and needs.

It's important to compare their offerings and read customer reviews to find the best fit for your specific situation.

Final Wrap-Up

In conclusion, Best no-exam life insurance policy offers a unique approach to securing your future without the hassle of medical exams. Make sure to weigh the pros and cons, consider the key factors, and choose a provider that aligns with your needs for a worry-free insurance experience.