Exploring the realm of Business interruption insurance cost sheds light on the complexities and essential aspects that businesses need to consider. From defining the concept to delving into the factors that influence costs, this topic encompasses a vital component of risk management.

Let's embark on a journey to uncover the nuances of Business interruption insurance cost.

Understanding Business Interruption Insurance Cost

Business interruption insurance is a type of insurance coverage that helps protect businesses from financial losses due to unexpected interruptions in their normal operations. This can include events like natural disasters, fires, or other incidents that force a business to temporarily close or reduce their operations.Factors that influence the cost of business interruption insurance include the size and type of business, the location of the business, the industry it operates in, the level of coverage needed, and the risk factors associated with the business.

Businesses with higher revenue and more complex operations may have higher premiums, as well as those located in areas prone to natural disasters or other risks.Examples of scenarios where business interruption insurance would be crucial include a restaurant that has to close for several weeks due to a fire, a manufacturing plant that experiences a machinery breakdown causing production delays, or a retail store that is forced to shut down temporarily due to a power outage in the area.

In these situations, having business interruption insurance can help cover ongoing expenses, lost income, and other costs incurred during the period of interruption.

Calculating Business Interruption Insurance Cost

When it comes to calculating the cost of business interruption insurance, there are several methods that insurance companies use. The size and type of business play a crucial role in determining the cost, as they affect the potential risks and financial impact of a business interruption.

Here is a step-by-step guide on estimating the cost of business interruption insurance:

Common Methods for Calculating Cost

- Insurance companies typically calculate the cost of business interruption insurance based on the business's net income and operating expenses.

- Some insurers may use a formula that takes into account the business's historical financial data, projected revenue, and other relevant factors.

- Another method is the gross earnings formula, which considers the business's gross profit margin and estimated revenue loss during the interruption period.

Impact of Business Size and Type

- Smaller businesses with lower revenue and fewer employees may have lower business interruption insurance costs compared to larger corporations with higher revenue and more extensive operations.

- The type of business also plays a role, as industries with higher risks of interruptions, such as manufacturing or healthcare, may have higher insurance costs.

- Businesses located in disaster-prone areas or with high exposure to external risks may also face higher insurance premiums.

Step-by-Step Guide to Estimate Cost

- Calculate the business's net income and operating expenses to determine the potential financial impact of an interruption.

- Consider the business's historical financial data and projected revenue to assess the overall risk of interruption.

- Determine the length of the interruption period and estimate the revenue loss during this time.

- Consult with an insurance agent or broker to get quotes and compare different coverage options and costs.

- Review and adjust the coverage limits and policy terms to ensure they align with the business's needs and budget.

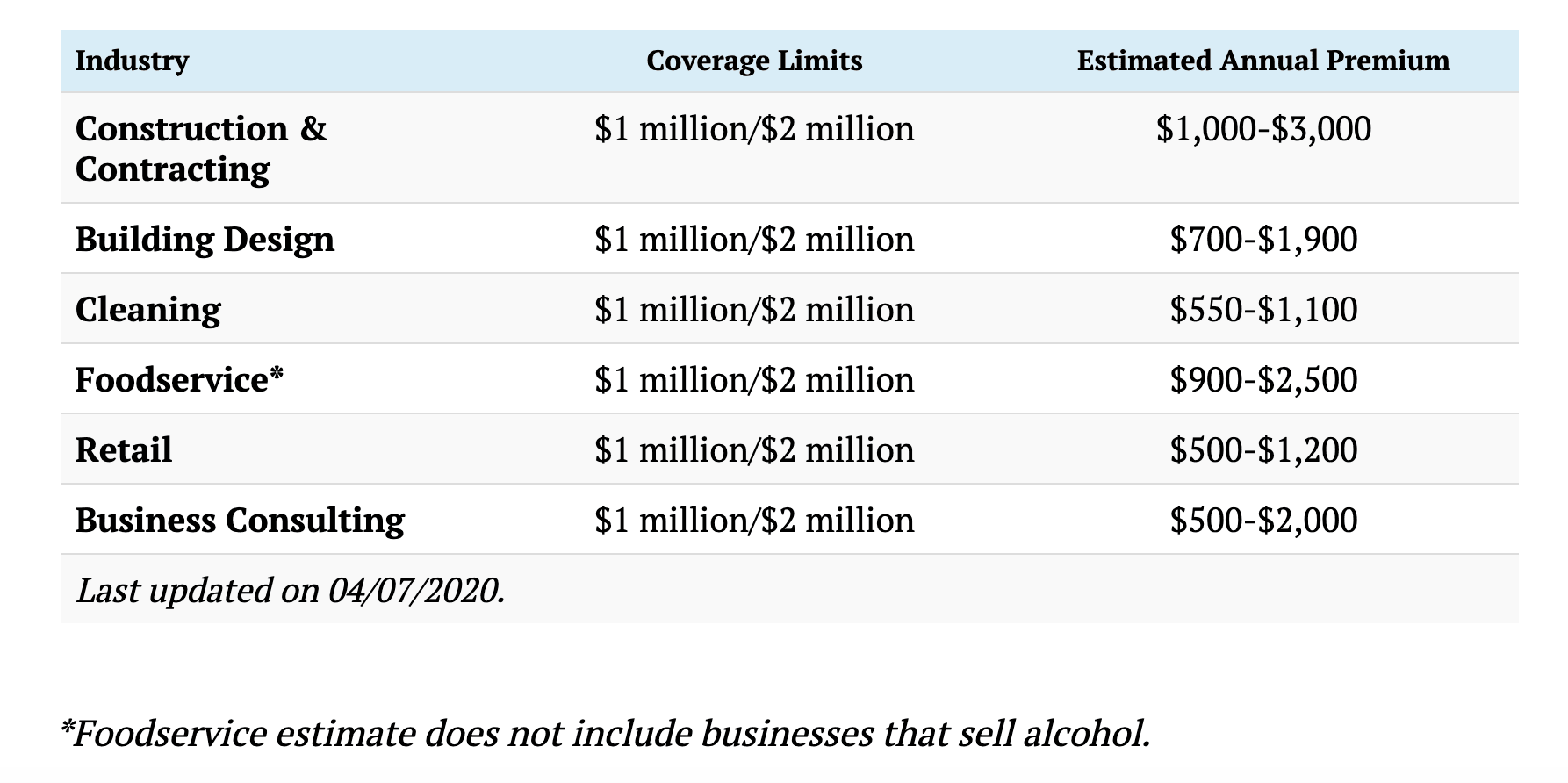

Comparing Business Interruption Insurance Cost Across Industries

When it comes to business interruption insurance, the cost can vary significantly depending on the industry in which a business operates. Understanding these variations is crucial for businesses to adequately prepare for potential risks and financial impacts.The cost of business interruption insurance is influenced by several factors, including the nature of the industry, the size of the business, the location, and the specific risks involved.

Some industries inherently face higher risks of disruptions, leading to higher insurance costs, while others may have lower risks and, therefore, lower insurance premiums.

Industries with High Business Interruption Insurance Costs

- Manufacturing: Industries that rely heavily on machinery and equipment are more susceptible to breakdowns and operational interruptions, resulting in higher insurance costs.

- Hospitality: Businesses in the hospitality sector, such as hotels and restaurants, are vulnerable to external factors like natural disasters, which can lead to significant revenue losses.

- Healthcare: Healthcare facilities require continuous operation to serve patients, making them more prone to disruptions that can result in high insurance costs.

Industries with Low Business Interruption Insurance Costs

- Professional Services: Businesses like law firms or consulting agencies may have lower insurance costs as they typically have fewer physical assets and face fewer operational risks.

- Retail: While retail businesses can face challenges like theft or fire, they may have lower insurance costs compared to industries with more complex operations.

- Technology: Tech companies often have flexible work environments and can quickly recover from disruptions, leading to lower insurance premiums.

The variations in business interruption insurance costs across industries can be attributed to the differing levels of risk exposure, operational complexity, and financial impact of potential disruptions. It is essential for businesses to assess their specific needs and risks to determine the appropriate coverage and budget for business interruption insurance.

Tips for Reducing Business Interruption Insurance Cost

Reducing business interruption insurance costs is essential for businesses to maintain financial stability during unexpected disruptions. Implementing effective strategies and focusing on risk management can significantly lower insurance expenses. Let's explore some tips to help businesses reduce their business interruption insurance costs.

Implement Robust Risk Management Practices

One of the most effective ways to reduce business interruption insurance costs is to implement robust risk management practices. By identifying potential risks and taking proactive measures to mitigate them, businesses can minimize the likelihood of disruptions and lower their insurance premiums.

For example, conducting regular risk assessments, investing in security measures, and developing a comprehensive business continuity plan can help businesses reduce their insurance costs.

Invest in Business Continuity Planning

Business continuity planning involves creating strategies to ensure that essential operations can continue during and after a disruption. By investing in business continuity planning, businesses can demonstrate to insurers that they are prepared to handle unexpected events, which can lead to lower insurance premiums.

Developing a detailed continuity plan that Artikels key processes, identifies critical resources, and establishes clear protocols for responding to disruptions can help businesses reduce their insurance costs.

Utilize Technology to Enhance Resilience

Technology can play a crucial role in enhancing business resilience and reducing insurance costs. Implementing robust IT systems, utilizing cloud-based solutions for data backup, and incorporating cybersecurity measures can help businesses minimize the impact of disruptions and lower their insurance premiums.

By leveraging technology to enhance resilience, businesses can demonstrate to insurers that they are less vulnerable to potential risks, leading to cost savings on insurance coverage.

Concluding Remarks

In conclusion, Business interruption insurance cost is a critical aspect that businesses must carefully evaluate to ensure financial resilience in times of crisis. By understanding the factors, calculating costs, comparing across industries, and implementing strategies for reduction, companies can navigate the realm of insurance with clarity and foresight.