Delving into the realm of Business liability insurance cost, this introduction aims to provide a comprehensive overview of the key aspects affecting insurance expenses and coverage options.

Detailing the factors influencing costs, types of insurance available, strategies to reduce expenses, and insights into understanding insurance quotes and premiums, this guide equips readers with essential knowledge to navigate the realm of business liability insurance.

Factors influencing business liability insurance cost

When it comes to determining the cost of business liability insurance, there are several key factors that come into play. These factors can significantly impact the premiums a business may have to pay for coverage. Let's explore some of the main factors influencing business liability insurance cost:

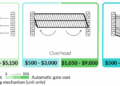

Industry Type

The industry in which a business operates plays a crucial role in determining the cost of liability insurance. Some industries are inherently riskier than others, leading to higher premiums. For example, a construction company may face more potential liabilities than a retail store, resulting in higher insurance costs.

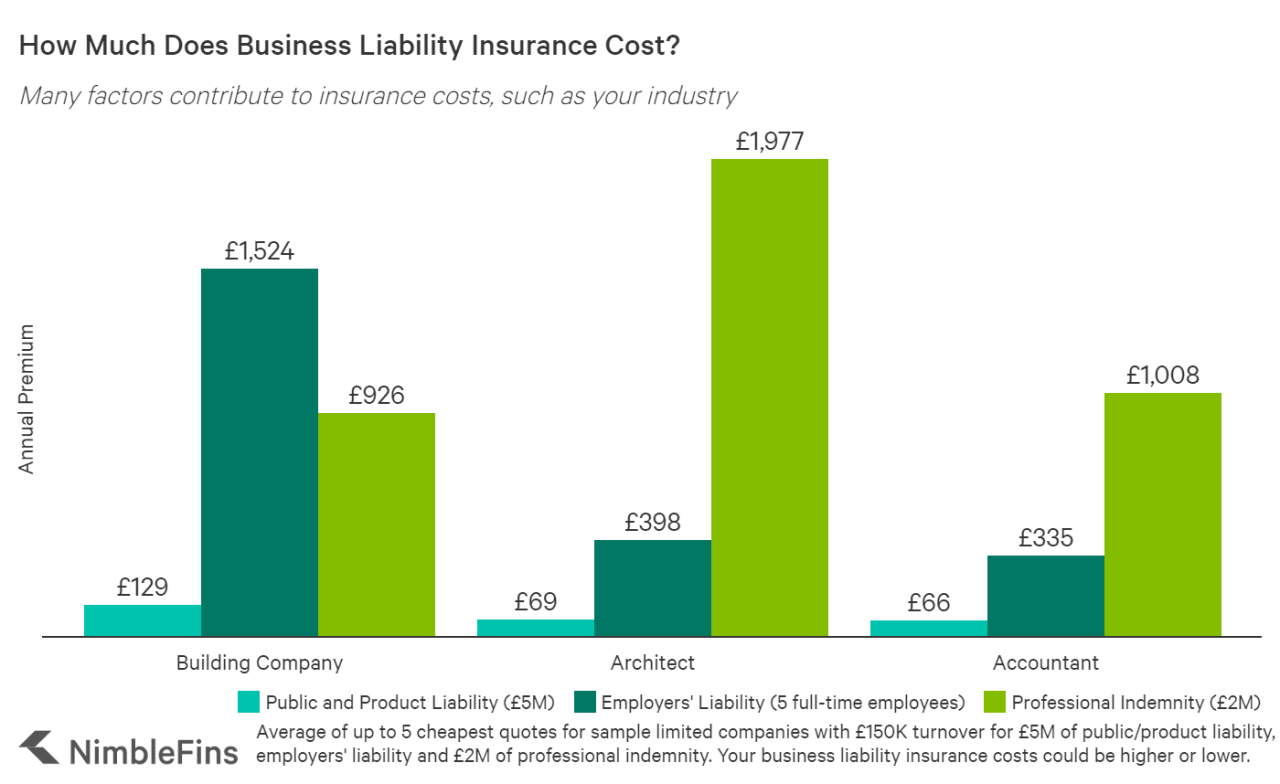

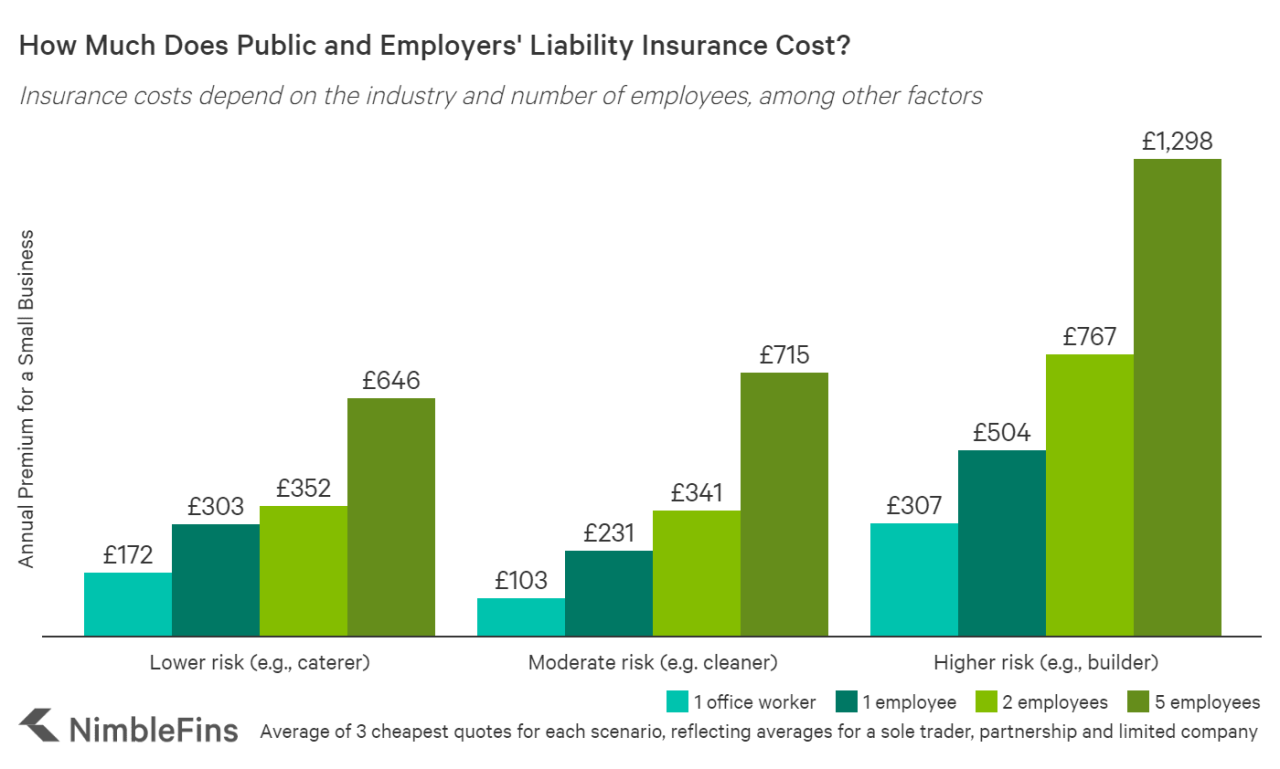

Business Size

The size of a business can also affect insurance costs. Larger businesses with more employees and higher revenues may face increased risks and liabilities, leading to higher premiums compared to smaller businesses.

Location

The location of a business can impact insurance costs due to factors such as local regulations, litigation trends, and environmental risks. Businesses located in areas prone to natural disasters or with higher crime rates may face higher insurance premiums.

Coverage Limits

The coverage limits chosen by a business can directly impact insurance costs. Higher coverage limits provide more protection but also come with higher premiums. Businesses need to assess their specific needs and risks to determine the appropriate coverage limits to balance protection and cost.

Previous Claims History and Risk Assessment

A business's previous claims history and risk assessment are important factors insurers consider when determining insurance costs. A business with a history of frequent claims or high-risk activities may face higher premiums. On the other hand, a business with a clean claims history and robust risk management practices may qualify for lower insurance premiums.

Examples of Risk Factors

- A restaurant that serves alcohol may face higher liability insurance costs due to the increased risk of alcohol-related incidents.

- A manufacturing plant with heavy machinery may have higher premiums to account for the potential risks of workplace accidents.

- A healthcare facility may pay more for liability insurance due to the higher likelihood of malpractice claims.

These are just a few examples of how different risk factors can influence the cost of business liability insurance. By understanding these factors and working to mitigate risks, businesses can better manage their insurance costs while ensuring adequate protection.

Types of business liability insurance

Business liability insurance comes in various types, each designed to protect against different risks and scenarios. Understanding the types of business liability insurance can help businesses choose the right coverage to safeguard their operations.

General Liability Insurance

- General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims.

- This type of insurance can protect businesses from lawsuits, medical expenses, and legal fees associated with covered claims.

- General liability insurance is essential for businesses that interact with customers, clients, or the public, as it provides broad coverage for common risks.

Professional Liability Insurance

- Professional liability insurance, also known as errors and omissions insurance, protects businesses from claims of negligence or inadequate work performance.

- It covers legal fees, settlements, and judgments related to professional mistakes or oversights that result in financial harm to clients.

- Professional liability insurance is crucial for businesses that provide services or advice to clients, such as consultants, lawyers, and healthcare professionals.

Product Liability Insurance

- Product liability insurance offers protection against claims related to injuries or damages caused by a business's products.

- It covers legal expenses, settlements, and court-ordered judgments resulting from defective products or product-related accidents.

- Product liability insurance is vital for businesses involved in manufacturing, distributing, or selling physical goods to consumers.

Strategies to reduce business liability insurance costs

Taking proactive measures to lower liability insurance premiums can significantly benefit businesses. By implementing risk management practices, businesses can reduce their insurance costs and create a safer work environment. Safety protocols and training programs play a crucial role in minimizing risks and, ultimately, saving money in insurance expenses.

Periodic policy reviews and adjustments are also essential in managing insurance expenses effectively.

Implementing Risk Management Practices

Risk management practices involve identifying, assessing, and prioritizing risks to minimize their impact on the business. By proactively managing risks, businesses can prevent costly incidents that could lead to insurance claims. This can result in lower premiums over time as insurers view the business as less risky.

Developing Safety Protocols and Training Programs

Creating and enforcing safety protocols in the workplace can reduce the likelihood of accidents and injuries. By providing training programs to employees on safety procedures and best practices, businesses can mitigate risks and lower the chance of insurance claims. This proactive approach can lead to cost savings by preventing incidents that could increase insurance premiums.

Regular Policy Reviews and Adjustments

Periodic reviews of insurance policies are essential to ensure that coverage aligns with the business's current needs. As businesses evolve, their insurance requirements may change, and it is crucial to adjust policies accordingly. By staying informed about policy changes and making adjustments when necessary, businesses can effectively manage insurance expenses and potentially reduce costs.

Understanding insurance quotes and premiums

Insurance quotes and premiums play a crucial role in determining the cost of business liability insurance. Understanding the components of an insurance quote and how they contribute to the overall premium is essential for businesses to make informed decisions.

Breakdown of Insurance Quote Components

- Insurance Coverage: The type and amount of coverage you choose will directly impact your premium. More comprehensive coverage will result in higher premiums.

- Deductible Amount: The deductible is the amount you agree to pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums.

- Business Size and Industry: The size and industry of your business will also affect your insurance costs. Riskier industries or larger businesses may face higher premiums.

- Claims History: A history of frequent or high-cost claims can lead to increased premiums as insurers view your business as higher risk.

Significance of Deductible Amounts and Coverage Limits

- Choosing a higher deductible can lower your premium but also means you'll have to pay more out of pocket in the event of a claim.

- Coverage limits determine the maximum amount your insurer will pay for a covered claim. Higher coverage limits can result in higher premiums.

- It's important to strike a balance between deductible amounts and coverage limits to find a policy that offers adequate protection at a reasonable cost.

Impact of Bundling Policies and Higher Deductibles

- Bundling insurance policies with the same provider can often lead to discounts on premiums for each policy.

- Opting for higher deductibles can help lower your premiums, but it's essential to ensure you can afford the out-of-pocket costs in the event of a claim.

- Consider bundling policies and adjusting deductible amounts to find the right balance between cost and coverage for your business.

Tips for Comparing Insurance Quotes

- Obtain quotes from multiple insurers to compare coverage options and premiums.

- Look beyond the cost and consider the coverage limits, deductibles, and exclusions of each policy.

- Work with an insurance agent or broker who can help you navigate the complexities of insurance policies and find the best coverage for your business.

Final Review

Concluding our discussion on Business liability insurance cost, it is evident that being well-informed and proactive is crucial in managing insurance expenses effectively. By understanding the various factors impacting costs, exploring different insurance types, implementing cost-saving strategies, and decoding insurance quotes, businesses can make informed decisions to protect their assets and mitigate risks.