Delving into the realm of Claims management in the insurance sector, this introductory paragraph aims to capture the attention of readers and provide a glimpse of what lies ahead.

Exploring the intricacies of efficient claims management and its impact on insurance companies and customers alike

Overview of Claims Management in Insurance Sector

Claims management in the insurance sector refers to the process of handling and resolving claims made by policyholders after experiencing an insured event. This involves investigating the claim, determining coverage, and providing the appropriate compensation to the policyholder.Efficient claims management is crucial for insurance companies as it directly impacts their reputation, financial stability, and customer satisfaction.

By promptly processing claims and ensuring fair settlements, insurance companies can build trust with their policyholders and retain them over the long term.

Importance of Efficient Claims Management

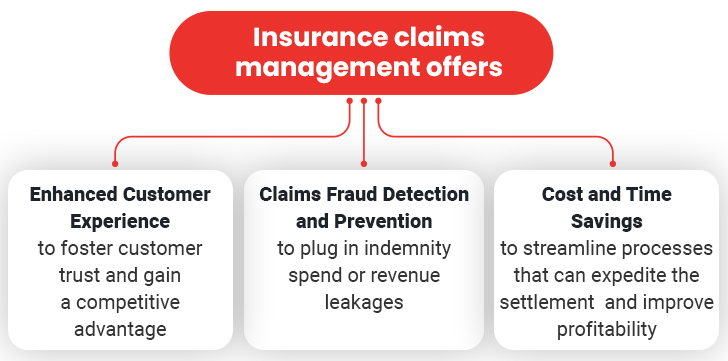

Effective claims management can significantly impact customer satisfaction and loyalty. When policyholders experience a seamless and hassle-free claims process, they are more likely to renew their policies and recommend the insurance company to others. On the other hand, delays or disputes in claims settlements can lead to frustration, distrust, and ultimately, loss of customers.

Examples of Impact on Customer Satisfaction

- Timely claims processing: When insurance companies efficiently handle claims and provide quick settlements, policyholders feel valued and supported during challenging times, leading to higher satisfaction levels.

- Transparent communication: Keeping policyholders informed about the status of their claims and explaining the process clearly can help manage expectations and reduce anxiety, enhancing overall satisfaction.

- Fair and consistent decisions: Making fair and consistent decisions in claims settlements builds trust and credibility with policyholders, reinforcing their confidence in the insurance company.

Processes Involved in Claims Management

Managing insurance claims involves several key steps that ensure the timely and accurate processing of claims for policyholders.

Claim Intake and Registration

- Upon receiving a claim, the first step is to intake and register the claim details into the system.

- This includes collecting information from the policyholder, verifying policy coverage, and creating a claim file.

Claim Investigation and Evaluation

- After registration, the insurance company investigates the claim to determine its validity and assess the extent of loss or damage.

- This involves collecting evidence, conducting interviews, and evaluating the claim against the policy terms and conditions.

Claim Processing and Settlement

- Once the investigation is complete, the claim is processed for settlement.

- The insurance company calculates the amount payable, considering deductibles, coverage limits, and any applicable depreciation.

- Finally, the settlement amount is approved and disbursed to the policyholder.

Role of Technology in Claims Management

Technology plays a crucial role in streamlining the claims management process, improving efficiency, and enhancing customer experience.

Examples of Software and Tools

- Claims Management Software:Programs like Guidewire, Duck Creek, and ClaimCenter automate and centralize claims processing, reducing manual errors and speeding up claim resolution.

- Image and Document Management Tools:Tools like DocuSign and Adobe Sign help digitize and organize claim documents, simplifying the documentation process.

- Analytics Platforms:Software such as SAS and IBM SPSS provide insurers with data analytics capabilities to identify trends, detect fraud, and improve claims handling efficiency.

Challenges Faced in Claims Management

Managing claims in the insurance sector comes with its fair share of challenges that can significantly impact the overall operations and financial performance of an insurance company. It is crucial to address these challenges effectively to ensure smooth claim processing and customer satisfaction.

1. Fraudulent Claims

Fraudulent claims pose a major challenge for insurance companies, leading to financial losses and increased premiums for honest policyholders. Detecting and preventing fraudulent activities is essential to maintain the financial stability of the company.

2. Complex Regulations

The insurance industry is heavily regulated, making it challenging for companies to navigate through complex laws and regulations governing claims management. Compliance with these regulations is crucial to avoid penalties and legal issues.

3. Inefficient Processes

Outdated systems and manual processes can slow down the claims management process, leading to delays in claim settlements and customer dissatisfaction. Implementing efficient technology solutions can streamline processes and improve overall efficiency.

4. Data Security Risks

With the increasing use of digital platforms for claims management, insurance companies face data security risks such as cyber-attacks and data breaches. Protecting sensitive customer information is paramount to maintain trust and credibility.

5. Rising Claim Costs

Rising claim costs due to inflation, increased medical expenses, and legal fees can put a strain on the financial performance of insurance companies. Implementing cost-containment strategies and negotiating favorable settlements can help mitigate these challenges.

Trends and Innovations in Claims Management

In the rapidly evolving landscape of the insurance sector, claims management is undergoing significant transformations driven by technological advancements and innovative practices. These trends are reshaping the way insurance companies handle claims, improving efficiency, accuracy, and customer satisfaction.

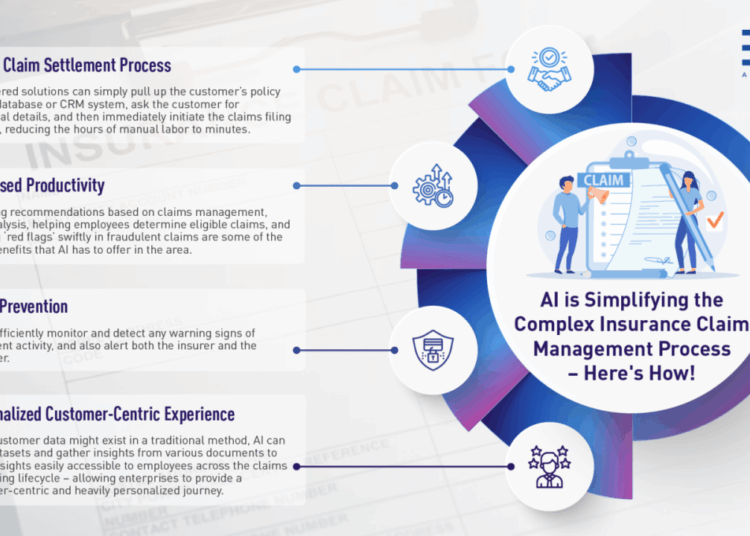

Integration of Artificial Intelligence

Artificial intelligence (AI) is revolutionizing claims management by automating processes, reducing manual intervention, and enhancing decision-making. AI-powered algorithms can analyze large volumes of data to detect fraud, assess risk, and expedite claim settlements. This technology streamlines operations, minimizes errors, and enables insurers to offer personalized services to policyholders.

Mobile Claims Processing

The rise of mobile claims processing solutions is simplifying the claims reporting and settlement process for policyholders. Mobile apps allow customers to submit claims, upload documentation, and track the status of their claims in real-time. This convenience enhances the overall customer experience, accelerates claim resolution, and reduces administrative costs for insurance companies.

Blockchain Technology

Blockchain technology is increasingly being adopted in claims management to ensure transparency, security, and efficiency. By creating immutable records of transactions and enabling secure data sharing among stakeholders, blockchain minimizes fraud risks, simplifies claim verification processes, and expedites settlements. This decentralized approach enhances trust between insurers, policyholders, and third-party service providers.

Predictive Analytics

The utilization of predictive analytics enables insurers to anticipate claim trends, assess risks, and optimize resource allocation. By analyzing historical data and identifying patterns, insurers can proactively manage claims, mitigate losses, and improve operational performance. Predictive analytics also helps in identifying fraudulent activities and enhancing fraud detection mechanisms.

Telematics and IoT Integration

The integration of telematics and Internet of Things (IoT) devices in claims management allows insurers to gather real-time data on policyholders' behavior and assets. This data-driven approach enables insurers to offer usage-based insurance, assess risks accurately, and expedite claims processing based on actual data.

Telematics and IoT integration enhance customer engagement, promote safety, and drive operational efficiencies in claims management.

Summary

In conclusion, the discussion on claims management in the insurance sector sheds light on the importance of streamlined processes and innovative practices for the future of the industry.