Delving into the realm of income protection insurance, this article aims to shed light on how this crucial financial tool operates, ensuring you understand its ins and outs thoroughly.

As we navigate through the intricacies of income protection insurance, you'll gain valuable insights into its mechanisms and benefits that can safeguard your financial stability.

Overview of Income Protection Insurance

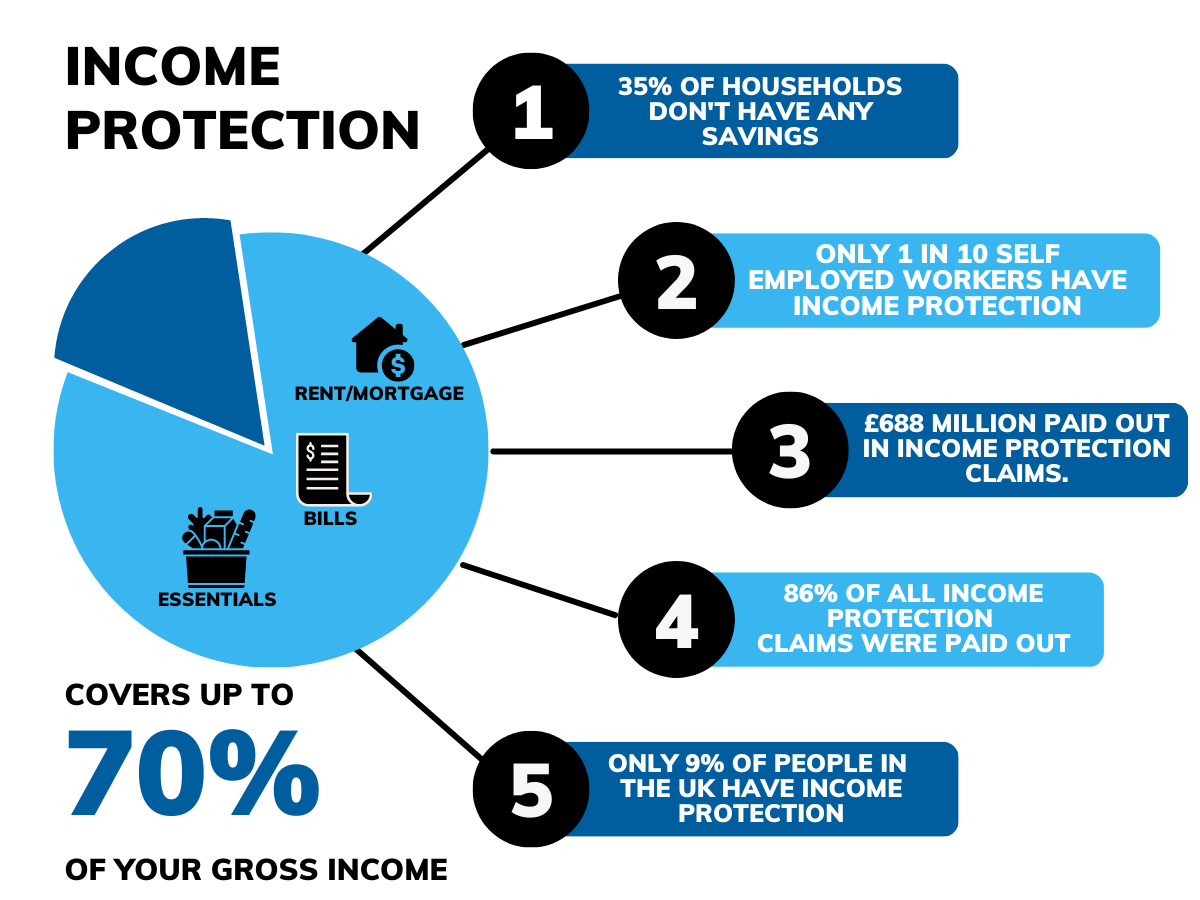

Income protection insurance is a type of policy that provides financial support in the form of a regular income if you are unable to work due to illness or injury. It ensures that you continue to receive a portion of your salary during your recovery period.Income protection insurance serves the purpose of safeguarding your financial stability during unexpected circumstances that prevent you from working.

It acts as a safety net to cover your essential expenses such as mortgage payments, bills, and other financial commitments.

Purpose of Income Protection Insurance

Income protection insurance aims to replace a portion of your lost income when you are unable to work due to illness or injury. It provides peace of mind knowing that you can still meet your financial obligations even if you are unable to earn an income.

- Protects your financial stability during periods of incapacity

- Ensures you can maintain your standard of living

- Reduces the financial stress associated with being unable to work

Benefits of Having Income Protection Insurance

Income protection insurance offers several benefits that can help you navigate through challenging times when you are unable to work.

- Provides a regular income stream to cover essential expenses

- Offers peace of mind and financial security for you and your family

- Allows you to focus on your recovery without worrying about finances

How Income Protection Insurance Works

Income protection insurance is designed to provide financial support if you are unable to work due to illness or injury. Here's how it works:

Replacing a Portion of Your Income

Income protection insurance typically replaces a percentage of your income if you are unable to work. This can range from 50% to 75% of your pre-disability income, depending on the policy you choose.

Waiting Period Before Benefits are Paid Out

There is usually a waiting period, known as the "elimination period," before benefits are paid out. This period can range from 30 days to 180 days, during which you must be unable to work due to your condition. The longer the waiting period, the lower the premium you may have to pay.

Factors Determining Coverage Amount

Several factors determine the amount of coverage you can get with income protection insurance. These factors include your occupation, income level, age, health, and the waiting period chosen. Insurers will assess these factors to determine the appropriate coverage amount for you.

Types of Income Protection Insurance Policies

Income protection insurance policies come in various forms to cater to different needs and situations. Let's explore the different types of income protection insurance policies available in the market.

Short-Term vs. Long-Term Income Protection Insurance

Short-term income protection insurance typically provides coverage for a limited period, such as one to two years, in case you are unable to work due to illness or injury. On the other hand, long-term income protection insurance offers coverage for a more extended period, often until retirement age or until you are able to return to work.

Indemnity Policies vs. Agreed Value Policies

Indemnity policies base the benefit amount on your actual income at the time of the claim. This means that the benefit paid may fluctuate based on your current earnings. Agreed value policies, on the other hand, set a fixed benefit amount at the time of policy inception, providing more certainty about the payout in case of a claim.

Group Income Protection Insurance

Group income protection insurance is typically offered by employers to their employees as part of a benefits package. This type of insurance covers a group of individuals under a single policy, often at a lower cost compared to individual policies.

Group income protection insurance provides financial protection to employees in case they are unable to work due to illness or injury.

Eligibility and Coverage

Income protection insurance is designed to provide financial support to individuals who are unable to work due to illness or injury. To be eligible for income protection insurance, individuals typically need to be of working age, usually between 18 and 65 years old.

Some policies may also have specific eligibility criteria based on occupation or health status.

Types of Income Covered

Income protection insurance can cover various types of income, including salaries, wages, bonuses, commissions, and self-employment income. It is important to carefully review the policy details to understand which sources of income are included in the coverage.

Limitations and Exclusions

While income protection insurance offers valuable financial protection, there are limitations and exclusions to be aware of. These may include pre-existing medical conditions, certain high-risk occupations, or waiting periods before benefits are paid out. It is essential to thoroughly review the policy terms and conditions to understand any restrictions on coverage.

Cost and Premiums

Income protection insurance premiums are typically calculated based on various factors such as age, occupation, income level, and the benefit amount you choose. The higher the benefit amount and the longer the benefit period, the higher the premium will be.

Factors Affecting Cost

- Your age: Younger individuals usually pay lower premiums as they are considered less risky.

- Your occupation: Riskier occupations may result in higher premiums due to the increased likelihood of injury or illness.

- Your health: Pre-existing medical conditions may lead to higher premiums or exclusions from coverage.

- The benefit amount: The higher the benefit amount, the higher the premium.

- The waiting period: A shorter waiting period before benefits kick in may result in higher premiums.

Tips to Lower Premiums

- Choose a longer waiting period: Opting for a longer waiting period before benefits are paid can help reduce premiums.

- Maintain a healthy lifestyle: Staying healthy through regular exercise and a balanced diet may lower your risk profile and result in lower premiums.

- Review your coverage regularly: As your circumstances change, make sure your coverage aligns with your current needs to avoid overpaying for benefits you may not require.

- Consider bundling policies: Some insurance providers offer discounts for bundling income protection insurance with other types of insurance policies.

Making a Claim

When it comes to making a claim for income protection insurance, there are specific steps and requirements that policyholders need to follow.

Documentation Required

When filing a claim for income protection insurance, the typical documentation required includes:

- Completed claim forms provided by the insurance company

- Medical records and reports supporting the reason for the claim

- Evidence of loss of income, such as pay stubs or tax returns

- Any other relevant documentation requested by the insurance provider

Timeframe for Receiving Benefits

Once a claim is approved, the timeframe for receiving benefits can vary depending on the insurance company and the specifics of the policy. However, in general, benefits are usually paid out on a monthly basis after a waiting period, which can range from 30 to 90 days.

Policyholders should check their policy documents for specific details regarding benefit payments.

Alternatives to Income Protection Insurance

While income protection insurance is a valuable financial safety net, there are alternative options to consider that may suit your needs better.

Emergency Funds

Having an emergency fund set aside can provide a cushion in case of unexpected financial setbacks, such as illness or injury. This fund should ideally cover at least three to six months' worth of living expenses.

Savings Accounts

Building up savings in a high-interest savings account can also serve as a backup plan in case of income loss. It is important to regularly contribute to this account to ensure it grows over time.

Investments

Investing in assets that generate passive income, such as rental properties or dividend-paying stocks, can provide an additional source of income in case of disability or illness. However, investments come with risks and may not always be reliable in times of financial need.

Disability Insurance

Another alternative to income protection insurance is disability insurance, which provides coverage specifically for disability-related income loss. It is important to carefully compare the coverage and benefits of disability insurance with income protection insurance to determine which option is more suitable for your situation.

End of Discussion

In conclusion, understanding how income protection insurance works can provide you with a safety net during uncertain times, offering peace of mind and financial security for you and your loved ones.