When it comes to safeguarding your financial well-being, understanding the nuances between Income Protection Insurance and Disability Insurance is crucial. This guide delves into the intricacies of both types of insurance, shedding light on their differences, benefits, and how they can work together to provide comprehensive coverage.

Income Protection Insurance

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

Income protection insurance is a type of policy that provides financial support to individuals who are unable to work due to illness or injury. It typically pays out a portion of the policyholder's income until they are able to return to work or reach retirement age.

Types of Income Protection Insurance Policies

- Short-term Income Protection: Offers coverage for a limited period, usually up to two years.

- Long-term Income Protection: Provides coverage for a more extended period, sometimes until retirement age.

- Accident and Sickness Income Protection: Specifically covers income loss due to accidents or sickness.

Benefits of Income Protection Insurance

- Peace of mind knowing you have financial support if you are unable to work.

- Helps cover essential expenses such as mortgage payments, bills, and daily living costs.

- Can be tailored to fit individual needs and budget.

Importance for Self-Employed Individuals

Self-employed individuals do not have access to sick leave or benefits provided by an employer. Income protection insurance can be crucial for them as it ensures that they have a source of income if they are unable to work due to illness or injury.

This type of policy can help self-employed individuals maintain their financial stability and business operations during challenging times.

Disability Insurance

Disability insurance provides financial protection to individuals who are unable to work due to a disability. It typically replaces a portion of the insured individual's income if they become disabled and are unable to work.

Definition and Coverage

Disability insurance covers a range of disabilities, including physical injuries, illnesses, and mental health conditions that prevent an individual from working. The coverage amount is usually a percentage of the individual's pre-disability income, providing financial support during the disability period.

Filing a Disability Insurance Claim

To file a disability insurance claim, the insured individual needs to provide medical evidence of the disability, including doctor's reports and other relevant documentation. The insurance company will review the claim and determine if the individual qualifies for benefits based on the policy terms.

Short-term Disability Insurance vs. Long-term Disability Insurance

- Short-term disability insurance typically covers disabilities that last for a few weeks to several months, providing immediate financial assistance during the early stages of disability.

- Long-term disability insurance, on the other hand, covers disabilities that extend beyond the short-term period, offering more extended financial protection for individuals unable to work for an extended period.

Role of Disability Insurance in Financial Planning

Disability insurance plays a crucial role in financial planning by ensuring that individuals have a source of income if they are unable to work due to a disability. It helps protect against the financial impact of a disability by providing a steady stream of income to cover living expenses and medical costs.

Key Differences Between Income Protection Insurance and Disability Insurance

Income protection insurance and disability insurance are both crucial forms of coverage designed to protect individuals in the event of illness or injury. While they share similarities in providing financial support when unable to work due to health issues, there are key differences between the two types of insurance that are important to understand.

Coverage Differences

Income protection insurance typically replaces a portion of your income if you are unable to work due to illness or injury for a specific period. On the other hand, disability insurance provides a lump sum payment if you become permanently disabled and are unable to work in any capacity.

Eligibility Criteria

Income protection insurance usually requires you to be employed and earning an income, while disability insurance may have stricter eligibility criteria related to the severity and permanence of the disability. Income protection insurance is generally more accessible to a wider range of individuals.

Suitability Scenarios

Income protection insurance is ideal for those who want to protect their ongoing income in case of a temporary health setback, such as recovering from surgery. Disability insurance, on the other hand, is more suitable for individuals with higher risks of permanent disabilities, such as those working in hazardous environments.

Complementary Role

Income protection insurance and disability insurance can work together to provide comprehensive coverage. Income protection insurance can offer short-term financial support until disability insurance kicks in for long-term protection in the event of a permanent disability. By having both types of insurance, individuals can ensure they have adequate coverage for various health scenarios.

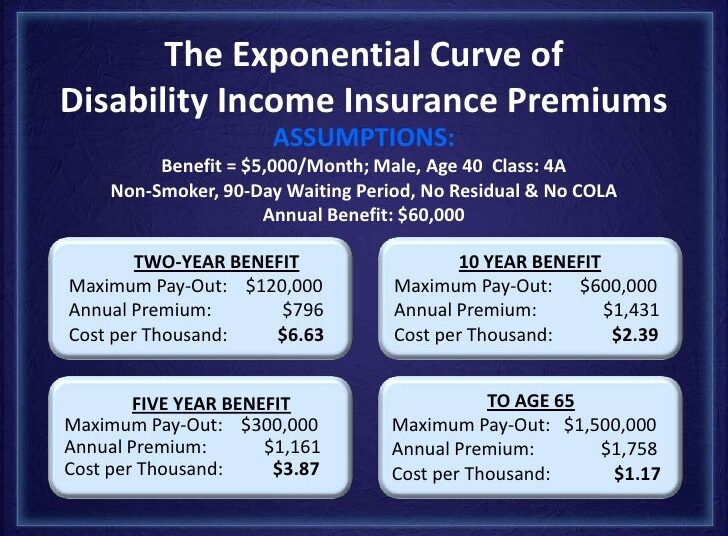

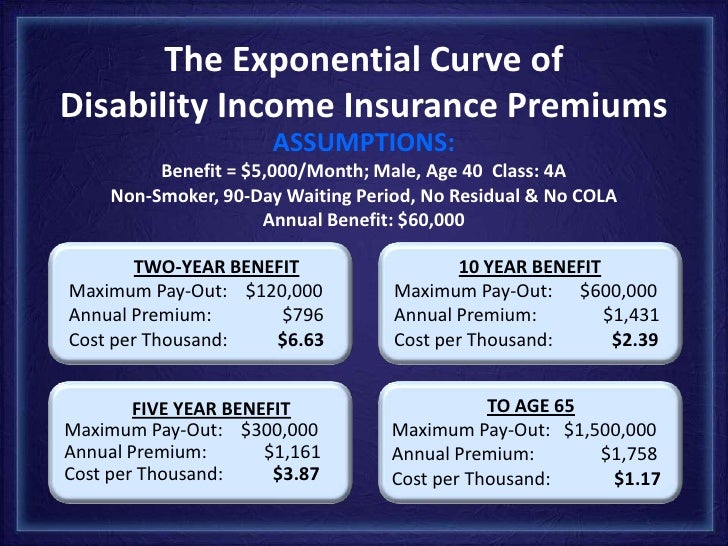

Cost and Benefits

Income protection insurance and disability insurance vary in cost and benefits, impacting individuals differently based on their financial situations. Let's explore the differences in cost-effectiveness and benefits between the two types of insurance.

Cost-Effectiveness

Income protection insurance is generally more cost-effective compared to disability insurance. This is because income protection insurance premiums are usually lower, especially for younger and healthier individuals. On the other hand, disability insurance tends to have higher premiums due to the broader coverage it offers.

Benefits Offered by Income Protection Insurance

Income protection insurance provides benefits that may not be covered by disability insurance. For example, income protection insurance typically offers a higher percentage of your regular income as a benefit compared to disability insurance. Additionally, income protection insurance may offer benefits for partial disabilities or temporary disabilities, which could be crucial for individuals who may not qualify for benefits under disability insurance.

Support for Individuals in Different Financial Situations

The benefits of income protection insurance and disability insurance can support individuals in various financial situations. Income protection insurance can provide a consistent stream of income replacement in case of illness or injury, helping individuals maintain their financial stability. Disability insurance, on the other hand, offers broader coverage for disabilities that may prevent individuals from working in their current occupation or any occupation.

Long-Term Financial Impact

Having income protection insurance can have a positive long-term financial impact by ensuring a steady income flow during times of illness or injury. This can help individuals cover their living expenses, mortgage payments, and other financial obligations without depleting their savings or retirement funds.

On the contrary, disability insurance can provide more comprehensive coverage but may come at a higher cost, affecting the long-term financial planning of individuals.

Ultimate Conclusion

As we conclude this exploration of Income Protection Insurance versus Disability Insurance, it becomes evident that both forms of coverage play vital roles in ensuring financial security during unforeseen circumstances. By weighing the options and understanding their unique benefits, individuals can make informed decisions to protect their income and livelihood.