Delving into the realm of life insurance cost calculators, this article unfolds a detailed exploration of how these tools function and the benefits they offer. From understanding the factors that influence costs to the importance of using such calculators, this piece aims to provide a comprehensive guide for individuals seeking clarity on life insurance expenses.

Introduction to Life Insurance Cost Calculator

Life insurance cost calculator is a valuable tool that helps individuals estimate the amount of premium they would need to pay for a life insurance policy. By inputting specific details such as age, gender, health status, and coverage amount, users can get an approximate idea of the cost associated with different types of life insurance policies.

How a Life Insurance Cost Calculator Works

A life insurance cost calculator functions by taking into account various factors that influence the cost of a life insurance policy. These factors typically include the individual's age, gender, smoking status, health conditions, coverage amount, and policy term. The calculator uses actuarial tables and algorithms to generate an estimated premium cost based on the provided information.

Benefits of Using a Life Insurance Cost Calculator

- Allows individuals to compare different policy options: By using a life insurance cost calculator, individuals can easily compare the premiums associated with various types of life insurance policies, helping them make an informed decision.

- Helps in planning for the future: Knowing the approximate cost of a life insurance policy can assist individuals in budgeting and financial planning for the future, ensuring they have adequate coverage.

- Saves time and effort: Instead of manually requesting quotes from multiple insurance providers, a life insurance cost calculator provides instant and convenient results, saving time and effort in the research process.

- Promotes transparency: By offering a clear breakdown of the factors influencing the cost of a life insurance policy, a cost calculator promotes transparency and helps users understand how premiums are calculated.

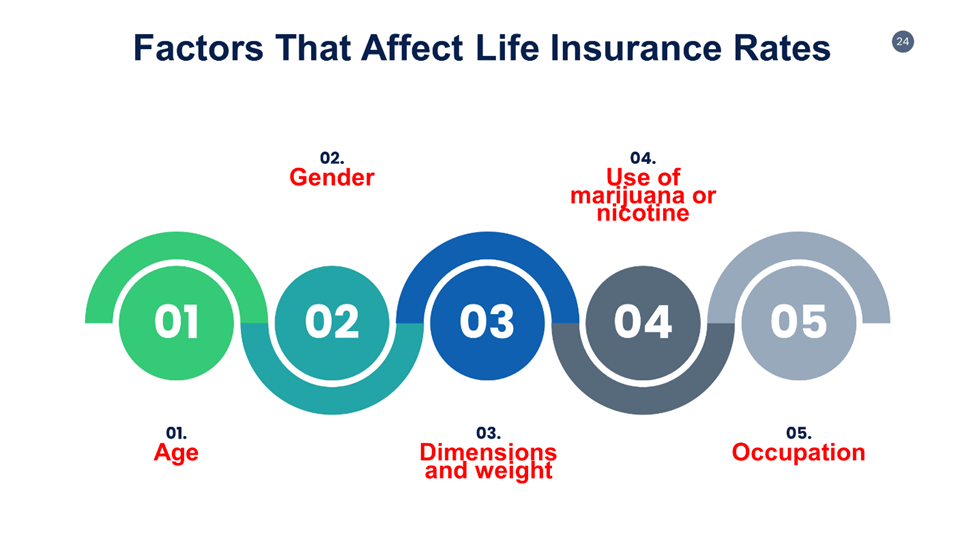

Factors Influencing Life Insurance Costs

When determining life insurance costs, several key factors come into play that can affect the premiums you pay. Understanding these factors is essential in making informed decisions about your life insurance coverage.

Age and Health

Age and health are two major factors that significantly impact life insurance premiums. Generally, younger individuals who are in good health are likely to pay lower premiums compared to older individuals or those with pre-existing health conditions. This is because younger and healthier individuals are considered lower risk by insurance companies, meaning they are less likely to make a claim.

Lifestyle Choices

Your lifestyle choices can also play a crucial role in determining your life insurance rates. Factors such as smoking, excessive alcohol consumption, or engaging in high-risk activities like skydiving can increase your premiums. These lifestyle choices can pose higher risks to insurance companies, leading to higher costs for coverage.

Importance of Using a Life Insurance Cost Calculator

When it comes to securing your family's financial future, understanding the cost of life insurance is crucial. Using a life insurance cost calculator can provide valuable insights and help you make informed decisions.

Accuracy of Estimates

Calculating life insurance costs manually can be complex and time-consuming. A life insurance cost calculator uses algorithms and data inputs to provide accurate estimates quickly. This ensures that you get a realistic view of the premiums you can expect to pay based on your unique circumstances.

Informed Decision Making

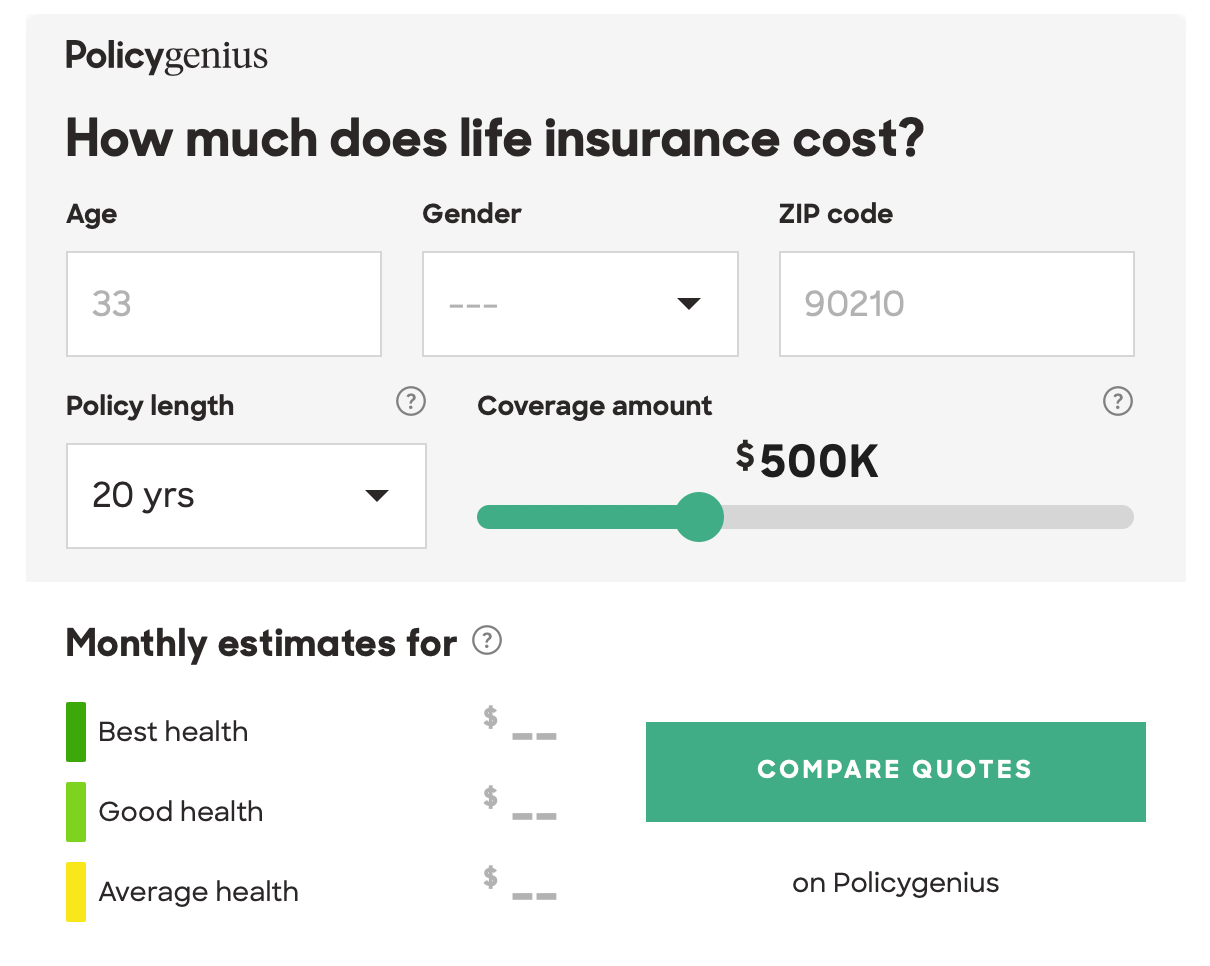

By using a life insurance cost calculator, individuals can compare different coverage options, benefit amounts, and policy terms to see how they impact the overall cost. This empowers individuals to make informed decisions about the type and amount of life insurance that best fits their needs and budget.

How to Use a Life Insurance Cost Calculator

To effectively utilize a life insurance cost calculator, follow the step-by-step guide below:

Entering Basic Information

- Start by entering basic personal details such as age, gender, and whether you smoke or not. These factors significantly impact your life insurance costs.

- Provide information about the coverage amount you are looking for and the term length of the policy.

Adding Health Information

- Include any pre-existing medical conditions you may have, as well as your height, weight, and overall health status.

- Input details about your family's medical history, as this can influence your life insurance premiums.

Reviewing Results

- Once you have entered all the necessary information, review the cost estimates provided by the calculator.

- Compare different coverage options and premium amounts to find a plan that suits your needs and budget.

Additional Features

- Some life insurance cost calculators may offer the option to adjust coverage amounts or term lengths to see how it impacts costs.

- Others may provide information on different types of life insurance policies available based on your inputs.

- Look for calculators that allow you to save your results or compare quotes from various insurance providers.

Last Recap

In conclusion, the use of a life insurance cost calculator can empower individuals to make well-informed decisions about their coverage needs. By leveraging this tool, individuals can obtain accurate estimates and gain valuable insights into their insurance options, ultimately leading to a more secure financial future.