Embark on a journey into the world of managing freelance income with QuickBooks for Beginners. Discover the essential tools and strategies to effectively track and organize your income as a freelancer, ensuring financial stability and success in your freelance career.

Understanding Freelance Income Management

Freelance income refers to the money earned by individuals who work independently on different projects for various clients. This type of income is often unpredictable and can vary from month to month based on the number of projects completed and the rates charged.

Challenges in Managing Freelance Income

- Irregular Cash Flow: Freelancers often face the challenge of unpredictable income streams, making it difficult to budget and plan for expenses.

- Invoicing and Payment Delays: Clients may delay payments or freelancers may struggle with invoicing, leading to cash flow issues.

- Tax Obligations: Freelancers are responsible for managing their own taxes, which can be complex and time-consuming.

- Lack of Financial Planning: Without a steady paycheck, freelancers may find it challenging to save for emergencies or retirement.

Importance of Effective Income Management for Freelancers

- Stability and Security: Proper income management helps freelancers stabilize their financial situation and plan for the future.

- Budgeting and Planning: By tracking income and expenses, freelancers can create budgets and financial plans to ensure they can cover their costs.

- Tax Compliance: Effective income management ensures freelancers meet their tax obligations and avoid penalties.

- Growth Opportunities: With a clear understanding of their income, freelancers can identify opportunities for growth and expansion in their business.

Introduction to QuickBooks for Beginners

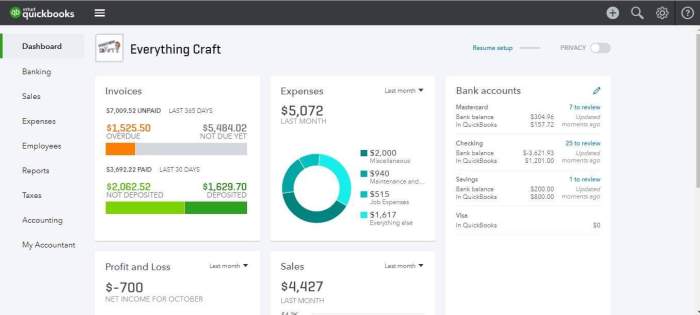

QuickBooks is a popular accounting software designed to help individuals and businesses manage their finances efficiently. It offers a range of tools and features to streamline financial tasks, including income tracking, expense management, invoicing, and reporting.Using QuickBooks for freelance income management can provide numerous benefits, such as simplifying the process of tracking income and expenses, automating invoicing and payment reminders, generating financial reports, and facilitating tax preparation.

By organizing financial data in one central location, freelancers can gain better insights into their cash flow and make informed decisions to improve their financial health.

Overview of Features in QuickBooks for Beginners

- Income Tracking: Easily record and categorize freelance income to keep track of earnings.

- Expense Management: Track expenses related to your freelance work, such as supplies, equipment, and travel.

- Invoicing: Create and send professional invoices to clients, with options for recurring billing.

- Financial Reports: Generate reports on income, expenses, profit and loss, and more to monitor business performance.

- Tax Preparation: Simplify tax preparation by organizing financial data and generating tax reports.

Setting Up QuickBooks for Freelance Income

Setting up a QuickBooks account for freelance income tracking is essential for managing your finances efficiently. It allows you to keep track of your income, expenses, and invoices in one place. Here's a guide on how to set up QuickBooks for freelance income:

Customizing QuickBooks for Freelance Income Tracking

To customize QuickBooks for freelance income tracking, follow these steps:

- Create a new account: Start by creating a new account specifically for your freelance income. This will help you separate your personal and business finances.

- Set up income categories: Customize your income categories to reflect the various sources of your freelance income. This could include different services, clients, or projects.

- Link your bank account: Connect your bank account to QuickBooks to automatically import your income transactions. This will save you time and ensure accuracy.

- Create invoices: Set up invoice templates in QuickBooks to easily bill your clients for your services. Customize the templates with your branding for a professional look.

Organizing Income Streams within QuickBooks

To effectively organize your income streams within QuickBooks, consider the following tips:

- Use tags or labels: Utilize tags or labels to categorize your income streams based on different criteria such as project type, client, or payment status. This will help you track and analyze your income more efficiently.

- Set up recurring invoices: For regular clients or projects, set up recurring invoices in QuickBooks to automate the billing process. This ensures you don't miss any payments and saves you time.

- Track expenses: In addition to tracking your income, make sure to also track your expenses in QuickBooks. This will give you a complete picture of your financial health and help you make informed decisions.

- Generate reports: Take advantage of QuickBooks' reporting features to generate income reports. Analyzing these reports can provide valuable insights into your freelance business performance and help you plan for the future.

Tracking Income and Expenses

Tracking income and expenses is crucial for freelancers to manage their finances effectively. By inputting this information into QuickBooks, freelancers can gain valuable insights into their financial health and make informed decisions for their business.

Inputting Income and Expenses into QuickBooks

- When recording income in QuickBooks, freelancers can create invoices for clients and mark them as paid once the payment is received.

- Expenses can be added by categorizing them into different accounts such as office supplies, utilities, or travel expenses.

- Freelancers can also connect their bank accounts to QuickBooks for automatic import of transactions, simplifying the tracking process.

Examples of Different Income Sources for Freelancers

- Income from project-based work, such as web design or writing services.

- Recurring income from retainer clients or subscription-based services.

- Affiliate marketing income from promoting products or services.

Categorizing and Tracking Expenses Effectively

- Assigning specific categories to expenses helps freelancers understand where their money is going and identify areas for potential cost savings.

- Regularly reviewing and reconciling expenses in QuickBooks ensures accuracy in financial reports and tax filings.

- Utilizing reports in QuickBooks, such as profit and loss statements, can provide a comprehensive overview of income and expenses over a specific period.

Invoicing and Payment Tracking

Invoicing and tracking payments are crucial aspects of managing freelance income effectively. By creating professional invoices and keeping track of payments, freelancers can ensure they get paid on time and maintain a healthy cash flow.

Invoicing Process in QuickBooks for Freelancers

- Create a new invoice by selecting the "+" icon and choosing "Invoice" in QuickBooks.

- Fill in the client's information, add the services or products provided, and set the payment terms.

- Customize the invoice template to reflect your brand and professionalism.

- Review the invoice for accuracy before sending it to the client.

Importance of Tracking Payments and Following Up on Overdue Invoices

- Tracking payments helps freelancers monitor their income and identify any late payments or outstanding invoices.

- Following up on overdue invoices is essential to ensure timely payment and maintain a good client relationship.

- Late payments can disrupt cash flow and impact the freelancer's financial stability.

Tips for Optimizing the Invoicing and Payment Tracking Workflow

- Set clear payment terms and deadlines to avoid confusion and encourage prompt payment.

- Use invoicing software like QuickBooks to automate the invoicing process and send reminders for overdue payments.

- Regularly reconcile payments received with invoices issued to stay organized and track income accurately.

- Consider offering incentives for early payments to incentivize clients to pay on time.

Generating Financial Reports

Generating financial reports in QuickBooks is crucial for freelancers to track their income, expenses, and overall financial health. These reports provide a detailed overview of the freelancer's financial activities, helping them make informed decisions about managing their income effectively.

Key Reports for Freelancers

- Profit and Loss Statement: This report shows the freelancer's income, expenses, and net profit over a specific period. It helps freelancers understand their financial performance and identify areas for improvement.

- Balance Sheet: The balance sheet provides a snapshot of the freelancer's assets, liabilities, and equity at a given point in time. It helps freelancers assess their financial position and track their financial health.

- Cash Flow Statement: This report shows how cash flows in and out of the freelancer's business over a specific period. It helps freelancers manage their cash flow effectively and plan for future expenses.

Importance of Financial Reports

Financial reports enable freelancers to analyze their income and expenses, identify trends, and make informed decisions about their business. By regularly reviewing these reports, freelancers can track their financial performance, identify areas of improvement, and plan for the future effectively.

Final Summary

In conclusion, mastering the art of managing freelance income with QuickBooks for Beginners is crucial for every freelancer looking to thrive in the gig economy. By implementing the tips and techniques discussed, you can take control of your finances and pave the way for a prosperous freelance journey.

Q&A

How can I effectively track my freelance income using QuickBooks?

To track your freelance income effectively with QuickBooks, you can set up different income categories, create invoices for clients, and regularly reconcile your accounts to ensure accuracy.

Is QuickBooks suitable for beginners with no accounting background?

Yes, QuickBooks is user-friendly and designed for individuals with no accounting experience. It offers a simple interface and step-by-step guidance to help beginners manage their finances efficiently.

What are the benefits of generating financial reports in QuickBooks?

Generating financial reports in QuickBooks allows freelancers to gain insights into their cash flow, track expenses, and monitor overall financial health. These reports help in making informed decisions and planning for the future.