Diving into the realm of Term life insurance quotes, this introduction aims to provide a comprehensive overview of what term life insurance is, its benefits, factors affecting quotes, and how to obtain them. It's a guide designed to enlighten readers on the intricacies of this crucial financial decision.

In this guide, we will cover various aspects of term life insurance, from understanding its fundamentals to navigating the process of obtaining quotes effectively.

Understanding Term Life Insurance

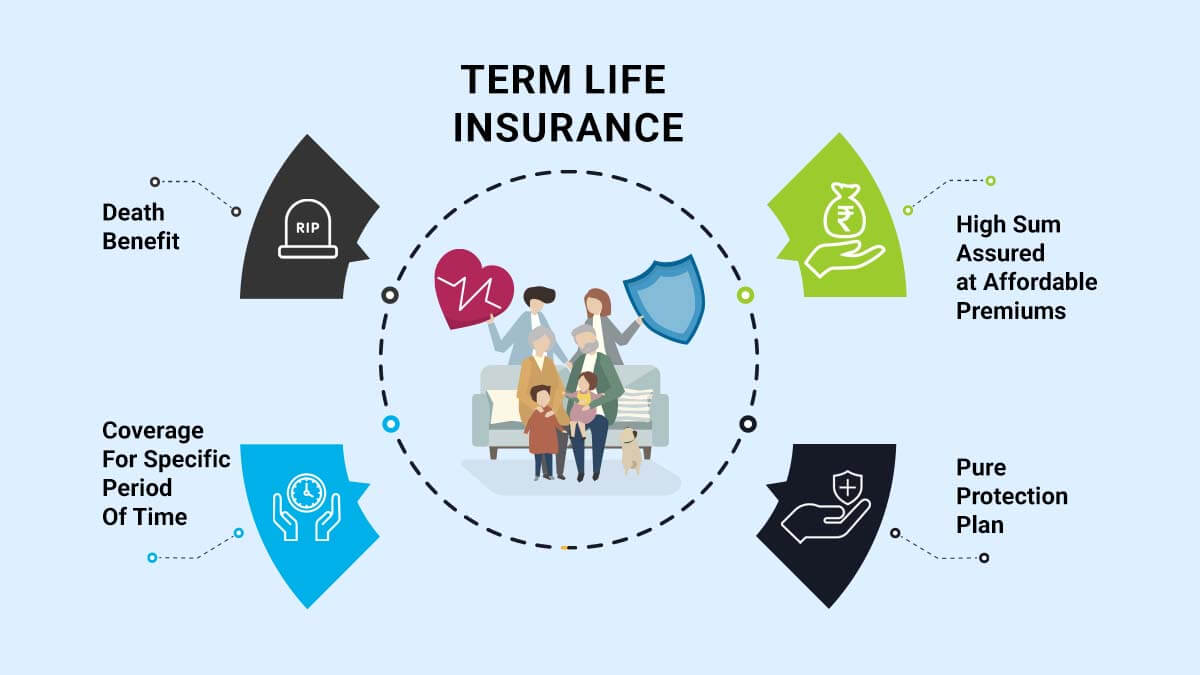

Term life insurance is a type of life insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. Unlike whole life insurance, which covers the insured for their entire life as long as premiums are paid, term life insurance only pays out a death benefit if the insured passes away during the term of the policy.

Key Features of Term Life Insurance Policies

- Term Length: Term life insurance policies are available in various term lengths, such as 10, 20, or 30 years. The premium amount is usually fixed for the duration of the term.

- Death Benefit: If the insured passes away during the term of the policy, the death benefit is paid out to the beneficiaries.

- Affordability: Term life insurance is generally more affordable than whole life insurance, making it a popular choice for those looking for temporary coverage.

- Renewability: Some term life insurance policies offer the option to renew the policy at the end of the term, although the premium may increase.

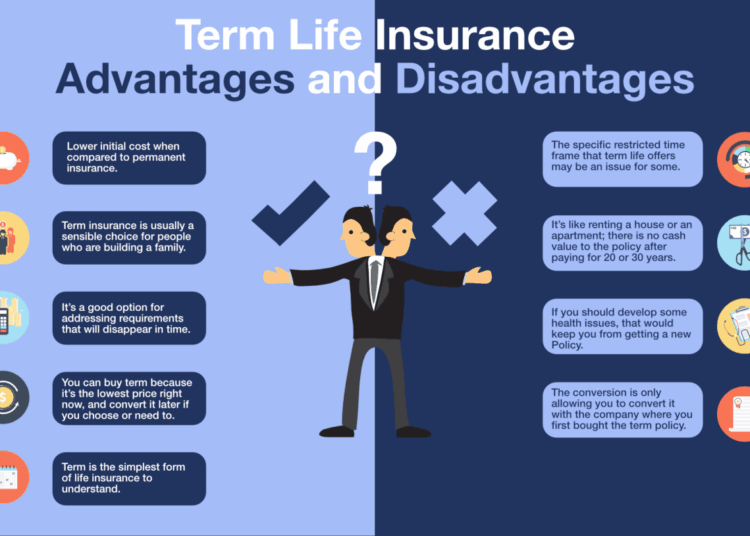

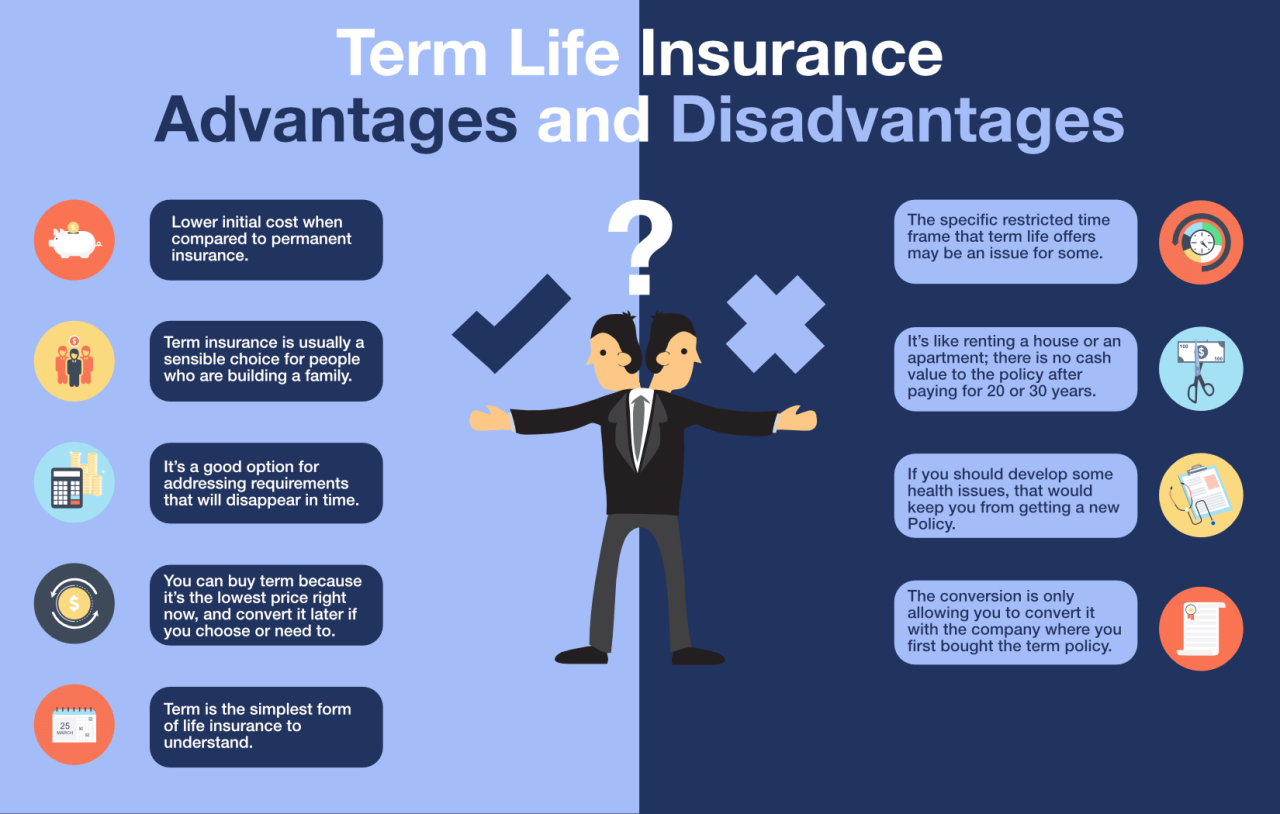

Benefits of Term Life Insurance

Term life insurance offers several advantages that make it a popular choice for many individuals and families. One of the key benefits is the affordability of term life insurance compared to other types of life insurance, making it accessible to a wider range of people.

Additionally, term life insurance provides a straightforward and easy-to-understand coverage structure, with clear terms and conditions.

Financial Protection for Specific Periods

Term life insurance is particularly beneficial for individuals who need coverage for a specific period, such as until their children are grown and financially independent or until a mortgage is paid off. This type of insurance allows policyholders to tailor their coverage to match their specific needs and obligations, providing peace of mind during critical life stages.

- Example: A young couple takes out a 20-year term life insurance policy to ensure that their children are financially protected until they reach adulthood.

- Example: A homeowner opts for a 30-year term life insurance policy to cover the duration of their mortgage payments.

Cost-Effectiveness

Compared to whole life insurance or universal life insurance, term life insurance is typically more cost-effective, especially for individuals who are looking for basic coverage without additional investment components. The premiums for term life insurance are generally lower, making it a practical choice for those on a budget or looking for temporary coverage.

- Term life insurance premiums are fixed for the duration of the policy, providing predictability in terms of financial planning.

- Young and healthy individuals can secure affordable term life insurance rates, especially if they opt for shorter-term policies.

Factors Affecting Term Life Insurance Quotes

When it comes to determining term life insurance quotes, several factors come into play that can influence the cost of coverage. Insurance companies take these factors into consideration to assess the level of risk associated with insuring an individual.Age, health, lifestyle, and coverage amount are significant factors that impact the cost of term life insurance.

Younger individuals generally receive lower quotes as they are considered less risky to insure. Similarly, individuals in good health with no pre-existing medical conditions are likely to receive more affordable quotes compared to those with health issues. Lifestyle choices such as smoking, drinking, or engaging in risky activities can also lead to higher insurance premiums.

Additionally, the coverage amount chosen by the policyholder will affect the cost of the premium, with higher coverage amounts resulting in higher quotes.

Impact of Term Length on Insurance Premiums

The length of the term selected for a term life insurance policy also plays a crucial role in determining the insurance premiums. Typically, shorter terms like 10 or 20 years come with lower premiums compared to longer terms such as 30 years.

This is because the risk of the insured passing away during a shorter term is lower, resulting in lower premiums. On the other hand, longer terms carry a higher risk for the insurance company, leading to higher premiums for policyholders.

Obtaining Term Life Insurance Quotes

When looking to obtain term life insurance quotes, the process typically involves reaching out to insurance providers directly or using online platforms to compare multiple quotes at once. It is essential to understand the steps involved in obtaining these quotes to make an informed decision about your coverage.

Comparing Quotes Effectively

- Request quotes from multiple insurance providers to compare rates and coverage options.

- Consider factors such as coverage amount, term length, and any additional benefits included in the policy.

- Use online tools and calculators to help you compare quotes side by side for easy evaluation.

- Look for discounts or special offers that may be available to lower your premium costs.

Reviewing Terms and Conditions

Before selecting a term life insurance policy based on quotes alone, it is crucial to review the terms and conditions of each offer carefully. Pay attention to:

- The length of the term and whether it aligns with your financial goals and needs.

- Any exclusions or limitations that may affect the coverage provided by the policy.

- The premium costs and whether they fit within your budget while providing adequate coverage.

- Any additional riders or options available to customize your policy to better suit your needs.

End of Discussion

In conclusion, Term life insurance quotes play a vital role in securing financial stability for your loved ones. By understanding the nuances of term life insurance policies and how to obtain quotes, you can make an informed decision that ensures protection and peace of mind.