When it comes to deciding between Progressive Commercial Auto Insurance and Geico, the choice can be a pivotal one that impacts your business. Let's delve into the details of each provider's offerings to help you make an informed decision.

Comparison of Coverage

When comparing Progressive Commercial Auto Insurance and Geico, it is important to look at the coverage options offered by both providers to determine which one best suits your needs.Progressive Commercial Auto Insurance offers a wide range of coverage options, including liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

They also provide additional benefits such as roadside assistance, rental reimbursement, and customized equipment coverage.On the other hand, Geico also offers similar coverage options such as liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage. However, Geico may have different limits, deductibles, and additional benefits compared to Progressive Commercial Auto Insurance.

Coverage Limits

- Progressive Commercial Auto Insurance: Offers flexible coverage limits that can be customized to meet your specific needs.

- Geico: Also provides customizable coverage limits, but the specific limits may vary depending on the policy.

Deductibles

- Progressive Commercial Auto Insurance: Allows policyholders to choose their deductibles, which can affect the cost of the premium.

- Geico: Offers a variety of deductible options, which can impact the overall cost of the policy.

Additional Benefits

- Progressive Commercial Auto Insurance: Includes perks such as roadside assistance, rental reimbursement, and coverage for customized equipment.

- Geico: Offers additional benefits such as emergency roadside assistance, rental car coverage, and mechanical breakdown insurance.

Pricing and Discounts

When it comes to choosing between Progressive Commercial Auto Insurance and Geico, pricing and discounts play a significant role in determining the overall cost of insurance coverage. Let's explore the pricing structures and discounts offered by each provider.

Pricing Structures

Progressive Commercial Auto Insurance typically offers competitive rates for commercial vehicles based on various factors such as the type of vehicle, coverage limits, driving history, and the number of vehicles insured. They may also take into account the business's industry and location to provide a customized quote.On the other hand, Geico also offers competitive pricing for commercial auto insurance, considering similar factors such as vehicle type, coverage options, and driving history.

Geico may offer discounts for policy bundling or insuring multiple vehicles under the same policy, which can help reduce overall costs.

Discounts Available

Progressive Commercial Auto Insurance

- Multi-Policy Discount: Save money by bundling commercial auto insurance with another policy, such as general liability.

- Safe Driver Discount: Rewards businesses with safe driving records by offering lower premiums.

- Business Experience Discount: Discounts may be available for businesses with a proven track record in the industry.

- Paid-in-Full Discount: Save money by paying the full premium upfront.

Geico

- Multi-Vehicle Discount: Insure multiple vehicles under the same policy to receive a discount on each vehicle.

- New Vehicle Discount: Save money when insuring a new commercial vehicle with Geico.

- Defensive Driving Discount: Complete a defensive driving course to qualify for a discount on premiums.

- Membership and Employee Discounts: Geico offers discounts to members of certain organizations or businesses.

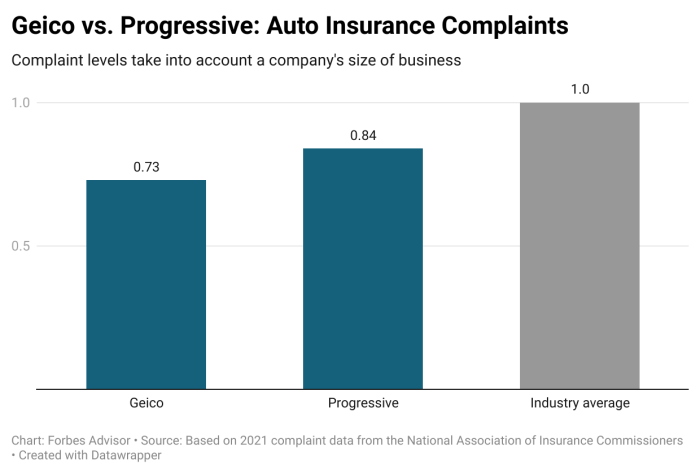

Customer Service and Claims Process

When it comes to commercial auto insurance, having reliable customer service and an efficient claims process is crucial. Let's compare the customer service experience and claims process of Progressive Commercial Auto Insurance and Geico.

Customer Service Experience

- Progressive Commercial Auto Insurance offers 24/7 customer service support through phone, online chat, and mobile app, ensuring assistance whenever needed.

- Geico also provides 24/7 customer service support through phone and online platforms, offering quick responses to inquiries and concerns.

- Both companies have user-friendly websites and mobile apps for easy access to policy information and account management.

- Progressive is known for its personalized customer service approach, with agents dedicated to helping policyholders understand their coverage options.

- Geico is recognized for its efficient customer service, with representatives trained to handle various insurance-related queries promptly.

Claims Process Efficiency

- Progressive Commercial Auto Insurance streamlines the claims process by allowing policyholders to file claims online or through the mobile app, making it convenient and hassle-free.

- Geico also offers an online claims filing option, providing a straightforward process for policyholders to report accidents and damages.

- Progressive is praised for its quick claims processing and efficient handling of claims, ensuring policyholders receive timely assistance and settlements.

- Geico has a reputation for its smooth claims process, with adjusters working promptly to assess damages and settle claims fairly.

- Both companies have a solid track record of resolving claims efficiently and providing support to policyholders throughout the claims process.

Fleet Management Tools and Technology

When it comes to fleet management tools and technology, insurance providers play a crucial role in helping businesses optimize their operations. Let's delve into the offerings of Progressive Commercial Auto Insurance and compare them with Geico in terms of technological advancements.

Progressive Commercial Auto Insurance

Progressive offers a range of innovative fleet management tools and technology to help businesses streamline their operations. They provide tools such as:

- Usage-based insurance: Progressive offers a usage-based insurance program called "Snapshot" that tracks driving behavior to provide personalized discounts based on safe driving habits.

- GPS tracking: The insurance provider offers GPS tracking devices that allow businesses to monitor their vehicles in real-time, optimize routes, and improve overall fleet efficiency.

- Mobile app: Progressive's mobile app provides easy access to policy information, claims filing, and roadside assistance, making it convenient for fleet managers to stay connected on the go.

- Driver monitoring: Through telematics technology, Progressive enables businesses to monitor driver behavior, identify risky driving habits, and implement strategies to improve safety.

Comparison with Geico

While Geico also offers some fleet management tools and technology, they may not be as extensive as Progressive's offerings. Geico provides basic tools such as:

- Online account management: Geico allows businesses to manage their policies online, make payments, and access policy documents easily.

- Claims reporting: Geico offers a user-friendly online claims reporting system for businesses to report accidents and track the status of their claims.

Overall, Progressive's focus on telematics technology, usage-based insurance, and real-time monitoring sets them apart in terms of fleet management tools and technology compared to Geico.

Closing Summary

In conclusion, the comparison between Progressive Commercial Auto Insurance and Geico reveals distinct differences in coverage, pricing, customer service, and technological tools. Understanding these nuances can assist you in selecting the insurance provider that best aligns with your business needs.

Quick FAQs

Is roadside assistance included in both Progressive Commercial Auto Insurance and Geico?

Progressive Commercial Auto Insurance offers roadside assistance as an optional add-on, while Geico includes it in some of their policies by default.

Do both providers offer customizable coverage options for commercial vehicles?

Yes, both Progressive Commercial Auto Insurance and Geico allow businesses to customize their coverage based on their specific needs and fleet size.

Which provider has a more user-friendly claims process?

Feedback suggests that Progressive Commercial Auto Insurance has a more streamlined and efficient claims process compared to Geico, providing quicker resolution for businesses.